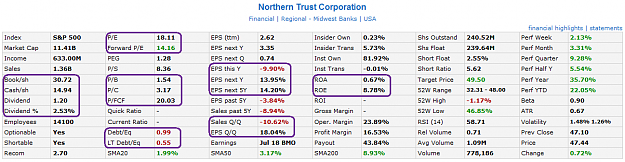

Hi Split, I'm looking at NTRS. It seems to be bouncing off the $ 48 inside a triangle, and is about to define if it continues rising or not.

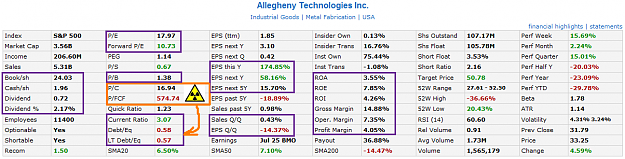

Watching the fundies, it seems to have very good values compare to the industry average, but there are 2 or 3 indicators that aren't so good and I raise questions. Please, could you help me to interpret this information?

Thanks.

Greg.

Watching the fundies, it seems to have very good values compare to the industry average, but there are 2 or 3 indicators that aren't so good and I raise questions. Please, could you help me to interpret this information?

Thanks.

Greg.