The Thief of Wall Street

- Post #648,061

- Quote

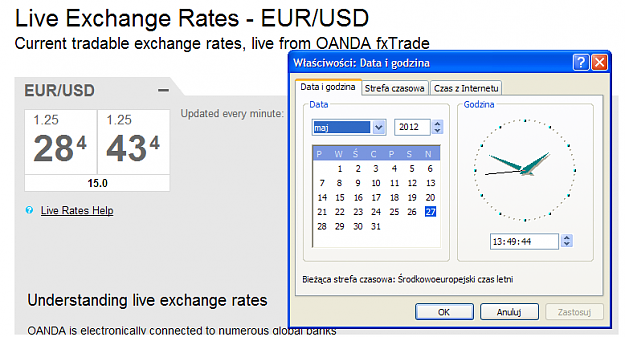

- May 27, 2012 1:18am May 27, 2012 1:18am

- Joined Sep 2008 | Status: Married - 5 Wives | 14,713 Posts

The Thief of Wall Street

- Post #648,063

- Quote

- May 27, 2012 1:56am May 27, 2012 1:56am

- Joined Sep 2008 | Status: Married - 5 Wives | 14,713 Posts

The Thief of Wall Street

- Post #648,065

- Quote

- May 27, 2012 2:27am May 27, 2012 2:27am

- | Joined May 2012 | Status: Smart trades | 211 Posts

- Post #648,066

- Quote

- May 27, 2012 3:12am May 27, 2012 3:12am

- Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 23,441 Posts | Online Now

#doyourownanalysisordietryin

- Post #648,068

- Quote

- May 27, 2012 6:04am May 27, 2012 6:04am

- Joined May 2012 | Status: Member | 776 Posts

- Post #648,069

- Quote

- May 27, 2012 6:28am May 27, 2012 6:28am

- Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 23,441 Posts | Online Now

#doyourownanalysisordietryin

- Post #648,071

- Quote

- May 27, 2012 7:55am May 27, 2012 7:55am

- | Joined Dec 2009 | Status: Bear | 1,009 Posts

- Post #648,072

- Quote

- May 27, 2012 8:16am May 27, 2012 8:16am

- | Joined May 2012 | Status: Smart trades | 211 Posts

- Post #648,073

- Quote

- May 27, 2012 9:26am May 27, 2012 9:26am

- | Joined Apr 2007 | Status: Member | 1,553 Posts

More on my Blog...

- Post #648,075

- Quote

- May 27, 2012 9:52am May 27, 2012 9:52am

- Joined May 2012 | Status: I'm Pawning 95Percent | 1,407 Posts

- Post #648,076

- Quote

- May 27, 2012 9:56am May 27, 2012 9:56am

- Joined Sep 2011 | Status: Minor crosses. Major pips. | 3,698 Posts

Time turns trend. - W.D. Gann

- Post #648,077

- Quote

- May 27, 2012 9:57am May 27, 2012 9:57am

- | Joined Mar 2009 | Status: Member | 173 Posts

- Post #648,078

- Quote

- May 27, 2012 9:58am May 27, 2012 9:58am

- Joined Oct 2007 | Status: Sniper | 14,763 Posts