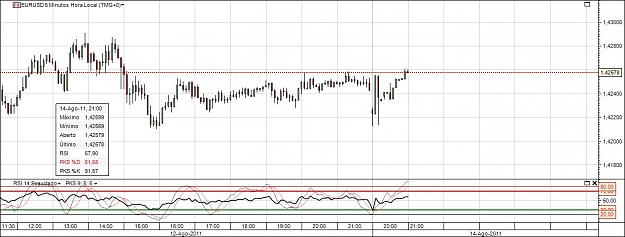

DislikedI have a target of 1.3700 and will make 10 attempts to get into a position that survives. If this doesn't work, wil set a new target based on then prevailing market conditions. A failed attempt not necessarily means a loss as I try to get into a position where a bounce is expected, close 50% of the position if the bounce occurs and let the rest 50% run.

The only reason I am short is that 1.4000 was penetrated few weeks earier. There is no other logic or factor to this trade and therefore it is just a gamble. Thats why I use the words "betting...Ignored

I think I read somewhere that Italy has 6 weeks of cash left before real problems set in, not to mention all the other troubled countries in EZ

New voice message: Why are you calling me? If I need you, I'll call you!