Forex Pros – The U.S. dollar was mixed against its major counterparts on Thursday in thin trade ahead of the New Year’s weekend, after a flurry of upbeat U.S. economic data on employment, manufacturing and home sales.

With many investors already away on year-end leave, trading volumes were low ahead of the New Year’s weekend, resulting in choppy trade.

During early U.S. trade, the greenback was down against the euro, with EUR/USD jumping 0.39% to hit a 2-week high of 1.3278.

Earlier in the day, data showed that euro zone retail sales increased at the fastest rate since May 2008 in December, while Italian business confidence surged to a 33-month high in November.

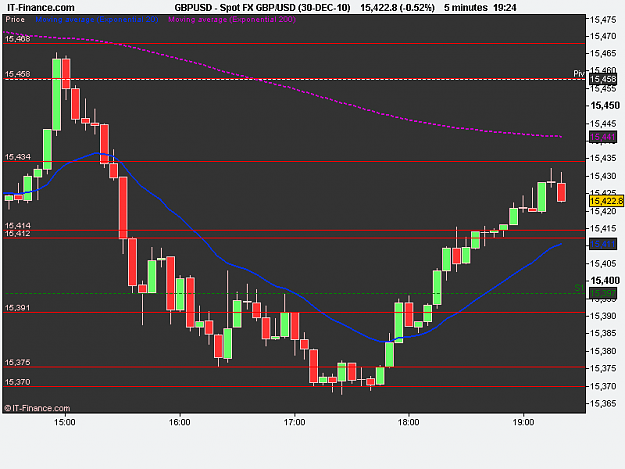

But the greenback was up against the pound, with GBP/USD tumbling 0.73% to hit 1.5387.

Earlier Thursday, industry data showed that U.K. home prices were likely to extend their decline in 2011 as mortgage restrictions and government spending were likely to discourage buyers in the new year.

Elsewhere, the U.S. dollar was up against the yen but down against the Swiss franc, with USD/JPY gaining 0.14% to hit 81.73, while USD/CHF tumbled 0.88% to hit 0.9372, after earlier falling to an all-time low of 0.9365.

Earlier in the day, data showed that Japan’s manufacturing purchasing managers’ index advanced for the second consecutive month in December.

Meanwhile, the greenback was up against its Australian and New Zealand counterparts, with AUD/USD slumping 0.57% to hit 1.0121, after earlier rising to a 28-year high of 1.0198, while NZD/USD shed 0.07% to hit 0.7681, after earlier jumping to a 5-week high of 0.7726.

However, the U.S. dollar was down against the Canadian dollar, with USD/CAD dropping 0.09% to hit 0.9999.

Also Thursday, data showed that Chinese manufacturing growth slowed for the first time in five months in December.

The dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, was down 0.24%.

Earlier in the day, the U.S. Department of Labor said that the number of individuals filing for initial jobless benefits fell more-than-expected in the week ended December 25, declining to a seasonally adjusted 388K, after falling to a revised 422K in the preceding week. Analysts had expected initial jobless claims to fall to 416K.

Meanwhile, a separate report said that manufacturing activity in the Chicago-area increased unexpectedly in December, while pending home sales jumped significantly more-than-expected in November.

With many investors already away on year-end leave, trading volumes were low ahead of the New Year’s weekend, resulting in choppy trade.

During early U.S. trade, the greenback was down against the euro, with EUR/USD jumping 0.39% to hit a 2-week high of 1.3278.

Earlier in the day, data showed that euro zone retail sales increased at the fastest rate since May 2008 in December, while Italian business confidence surged to a 33-month high in November.

But the greenback was up against the pound, with GBP/USD tumbling 0.73% to hit 1.5387.

Earlier Thursday, industry data showed that U.K. home prices were likely to extend their decline in 2011 as mortgage restrictions and government spending were likely to discourage buyers in the new year.

Elsewhere, the U.S. dollar was up against the yen but down against the Swiss franc, with USD/JPY gaining 0.14% to hit 81.73, while USD/CHF tumbled 0.88% to hit 0.9372, after earlier falling to an all-time low of 0.9365.

Earlier in the day, data showed that Japan’s manufacturing purchasing managers’ index advanced for the second consecutive month in December.

Meanwhile, the greenback was up against its Australian and New Zealand counterparts, with AUD/USD slumping 0.57% to hit 1.0121, after earlier rising to a 28-year high of 1.0198, while NZD/USD shed 0.07% to hit 0.7681, after earlier jumping to a 5-week high of 0.7726.

However, the U.S. dollar was down against the Canadian dollar, with USD/CAD dropping 0.09% to hit 0.9999.

Also Thursday, data showed that Chinese manufacturing growth slowed for the first time in five months in December.

The dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, was down 0.24%.

Earlier in the day, the U.S. Department of Labor said that the number of individuals filing for initial jobless benefits fell more-than-expected in the week ended December 25, declining to a seasonally adjusted 388K, after falling to a revised 422K in the preceding week. Analysts had expected initial jobless claims to fall to 416K.

Meanwhile, a separate report said that manufacturing activity in the Chicago-area increased unexpectedly in December, while pending home sales jumped significantly more-than-expected in November.

{Promotion Removed}