DislikedNo offense taken. Would you care to share your exit strategy?

And trust me I rather read posts before doing backtests so I read all this thread and read multiple times PC posts and James. I have to re-read PipMan though, maybe he has something magical to say. And it is all sounds good until you do backtests. So could you share your exit strategy?Ignored

I will try my best to answer Your question.

I understand why you rather will read posts before doing something, because I myself did so not so long time ago. For me, when I did no understand enough what I have to do for good trading it was easy to read some authors's posts to understand something through their experience. I have read very lot of authors, and did understand almost nothing

Then I start to apply what I have read in their posts in my own trading (with cents)... after some months,...

ONLY after some months of forward-and-back-testing I did realized for me what about are they all talking...

For now I have 4 different trading approachs in my pocket... but as I said already - For every one of them I gave for near 2-4 months to understand for every one. By "understanding" I mean rather my confidence for them.

What I want to say you by this is - you will not catch the whole concept only by reading... You will have to apply this concept to understand it fully.

If you want to learn how to go by bycicle... you have to go by bycicle.

(sorry for this metaphor)

There is now other way there.

I understand, that now I speak with you mostly not about DIBS, entries, exits, etc.... But - I try to give you something, that I own not so long time for now... And IT is something that I so needed earlier like trader.

This something is mental. Yes! MENTAL!

I will explain.

Earlier I think that professional traders ALWAYS KNOW WHAT THEY ARE DOING. Yes, I knew that they have losses like others, but I did think that in whole picture they know something more than I or You.

But now - I know for sure, that this is wrong. They do not know MORE than I or You. Of course, they have a lot of experience, and this makes them more clever.... but... Their edge is THEIR TRADING PLAN!!!!!!!

No more no less.

Some little tip to You - pros-trader doesn't know for sure the outcome of any his trade!!

Do you get it? Does it tell you something???

Now, what is the different between you and any pros in terms of knowing trade's outcome???? No different!!!! You do not know what the outcome will be, and he doesn't know for sure what the outcome will be.

But he (pros) knows for sure for what he is looking for in his trading!!!!!!!!

For example by trading DIBS we all are looking for TAILS in our trading.

Catching TAILS is our goal.

Look - it is simple - if we are in a trade, and price immediately reverses against our position - does this scenario fit our plan? No way! We exit this trade with some little loss and wait for the next one. Why? Because our goal is catching TAILS, Runners. This is what we are looking for in our trading.

And if we are in a trade which has profit for us now, do we have to exit it right now just because we want to do this?? No! Because we have our plan, plan tells us to catch tails, and tails are by their definition more than 11-20 pips. So - what we can do with this trade is - trailing stop with it and take profit when our plan tells us to do it.

Do you want to know how the plan of pros looks?

First - all pors have their set up's for entering the trade. These set up's have different forms, different names, different goals. But - they tell to trader when to enter the market. And guess what !!!!!! Pro-Trader "test" every set up which he sees on chart and takes every trade. Why? If you remember - no one trader doesn't know the outcome of any trade.

Only way to know will this particular trade be loss or profit - is to take it!

So - trader has to trade every valid set up which he sees!

Only this way trader can take all trades which will end with profit.

Of course - he has to pay for this "good" trades through those little loss trades. They are like taxes.

Pros do not predict the market. NEVER!

They trade possibilities.

I write all this for you, because I feel you do not know all these stuffs.

Now - DIBS

Like Razor_Trader said yet - you have all you need for entry.

Inside bar, filter (up-day, down-day), 1:1 matrix, timeframe and sessions.

Do you need some discretionary? - You have it yet! It is in RULES. And it is - you have to tend to trade during "active hours" of currency which you are trading. That's it!

I may be wrong - but what IMO about enterys in trade - there is no more needing to be discretionary. Trader just HAVE to trade EVERY set up which fits to RULES.

Where you really need some discretionary - is EXIT.

But - after You will find some good for you exit-method - it will become some sort of rule too.

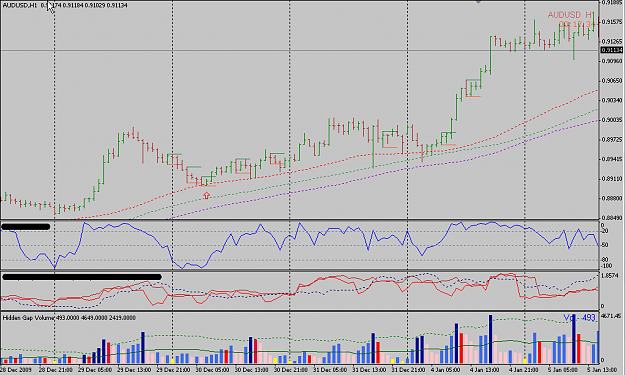

As for me - now I trade with MA's from some other method - Tunnel of Vegas. They are - 169 and 144. I take every set up for enetery, and tend to hold my positions with this MA's on 1h chart.

What helps me the most in my trading - is my confidence in method which I trade.

Trading doesn't have to be hard. It is simple.... but not easy.

About discretionary here - I look at only 1 timeframe, and Peter Crowns (if I right undertsand him) - looks at 1Day timeframe too. So - my exits may be some different than his.

But this is great - because if we will do the same things - traders from pits will catch very easy us soon enough, because they will know for sure what we all are doing. Get it?

And what I did find in Peters words is -

"Because the bar was so narrow, my protective sell stop was ONLY 6 pips below my entry. Since the risk was so low I was able to multiply my size accordingly, and had 4 times the position I typically have on these trades."

(No Free Lunch but all the Free Coffee you can drink. Post #92)

This gives me hint, that Peter allows himself to lose some nearly same amount of $$ in every trade. Not loss based on numbers of pips, but based on amount of $$. For example - Stop loss - 10 pips then 1pip=4$, Stop loss - 40pips then 1pip=1$..... Something like this.

And something else again about discretionary:

every day when you start trading - you have to look at economic calendar, to know if any of the most major events will be today, or next day.... Like for exemple James did tell us about third Friday in March, June, September, December. Or bank holydays.... You get it...

This is all for you, Andy.... read it carefully, manytimes, and absorb it well.

Good luck, best trades to you!!!!

Thanks!