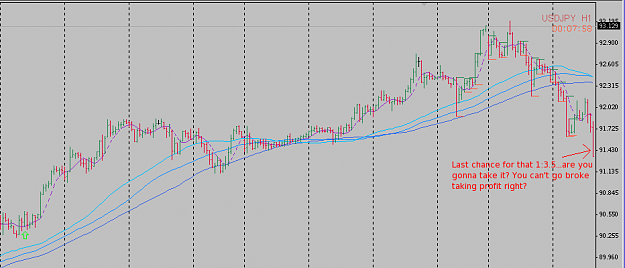

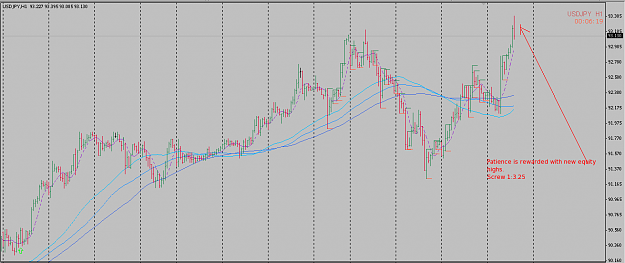

I have the "you can't go broke taking profits" argument every day at work....mostly with scalpers who think that just because price has moved X%, that it can't move any more.............these are also the people who usually have a high % of winners, but end up negative due to one or two losers. These are also usually the same people who cannot walk away with a small loss at the end of a trading period, which for me is from 9:55 to about 11:30 est

if you do not have a systematic way of taking profit and loses.......how do you decide to take them?

The best thing about switching from playing IB's on daily charts to one minute charts is the increased number of opportunities on a daily basis.

Having said all that, i have heard people say that the Turtle method "no longer works"...I've never tested it myself, but isnt this like saying that price no longer breaks out?

if you do not have a systematic way of taking profit and loses.......how do you decide to take them?

The best thing about switching from playing IB's on daily charts to one minute charts is the increased number of opportunities on a daily basis.

Having said all that, i have heard people say that the Turtle method "no longer works"...I've never tested it myself, but isnt this like saying that price no longer breaks out?

DislikedThat is absolutly true but the mindset is completely different. You would take more care of a large some of money whereas the smaller does entice greater risk. In the end, after read the PDF on the turtles, IBs have alot in common, which to me is no surprise. Breakout methodology regardless of how you take has a strong trend upside and a very discipline demanding range side.

I couldnt help but place these lines from the PDF that stand out to anyone who has taken enough time to read this thread.

"Consistancy - The Turtles were told to be very...Ignored