Hi all, I've been studying and implementing the DIBS method for a awhile now, with mixed results.

From what I've experienced, if you aim to go long, really long, as Peter Crown's advocated, almost ALL of these trades get stopped out.

The only time this method seems to work with some degree of reliability is short term, during the London open to close; I've had some really killer trades during this session.

But even this can get quite irritating on occasion when a slew of trades in a row get stopped out. This week was particularly rough. Lots of victims of institutional stop-hunting.

I'm thinking about moving over to crude oil futures which have fared much better during the past month with inside bar breakouts.

Anyway, is anybody here still using this method with a high degree of success?

If so, how are you trading this technique? The more specific, the better .

.

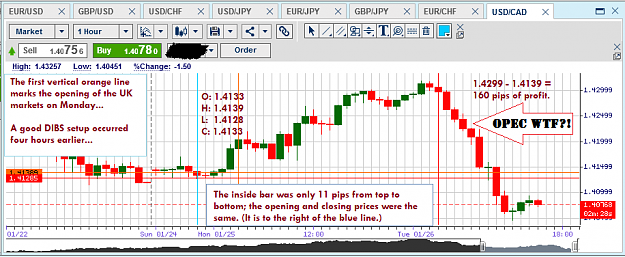

As for yours truly, I'm using the 1 hr time-frame...taking longs only on inside bar breakouts above the prior days close, and shorts on inside bar breakouts below the prior days close, and always closing out my position before the end of the day.

http://imagizer.imageshack.us/v2/800...0/845/ljoh.png

- Jason

Peace and Pips.

http://www.forexfactory.com/showthread.php?t=86766 <---DIBS method for anybody not familiar with it.

From what I've experienced, if you aim to go long, really long, as Peter Crown's advocated, almost ALL of these trades get stopped out.

The only time this method seems to work with some degree of reliability is short term, during the London open to close; I've had some really killer trades during this session.

But even this can get quite irritating on occasion when a slew of trades in a row get stopped out. This week was particularly rough. Lots of victims of institutional stop-hunting.

I'm thinking about moving over to crude oil futures which have fared much better during the past month with inside bar breakouts.

Anyway, is anybody here still using this method with a high degree of success?

If so, how are you trading this technique? The more specific, the better

As for yours truly, I'm using the 1 hr time-frame...taking longs only on inside bar breakouts above the prior days close, and shorts on inside bar breakouts below the prior days close, and always closing out my position before the end of the day.

http://imagizer.imageshack.us/v2/800...0/845/ljoh.png

- Jason

Peace and Pips.

http://www.forexfactory.com/showthread.php?t=86766 <---DIBS method for anybody not familiar with it.