Sometimes.................

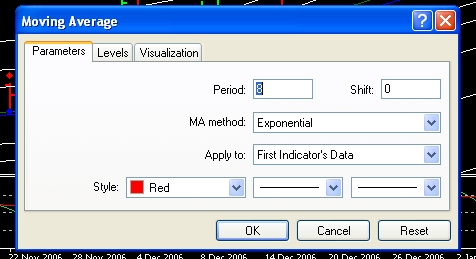

To become familiar with how it reacts to price change, try a forward test by either marking your chart each time the color changes as it crosses the "0" line and then observing the results or take a "screenshot" everyday for the same analysis. This indicator is useful with this method when applied as discussed earlier in this thread. When used on smaller time frames and charts, it will often give false signals because it repaints. Although I have found interesting results when used on a 4 hour chart.

To become familiar with how it reacts to price change, try a forward test by either marking your chart each time the color changes as it crosses the "0" line and then observing the results or take a "screenshot" everyday for the same analysis. This indicator is useful with this method when applied as discussed earlier in this thread. When used on smaller time frames and charts, it will often give false signals because it repaints. Although I have found interesting results when used on a 4 hour chart.

DislikedDoesn't the Solar Wind repaint itself when a new bar opens?

It always looks good backtesting but forward testing the current bar can change depending on the next bar.Ignored