Fozzy's done a good job of describing his system, which is an offshoot of the Dynamic RSI system. I highly recommend reading his description if you have not.

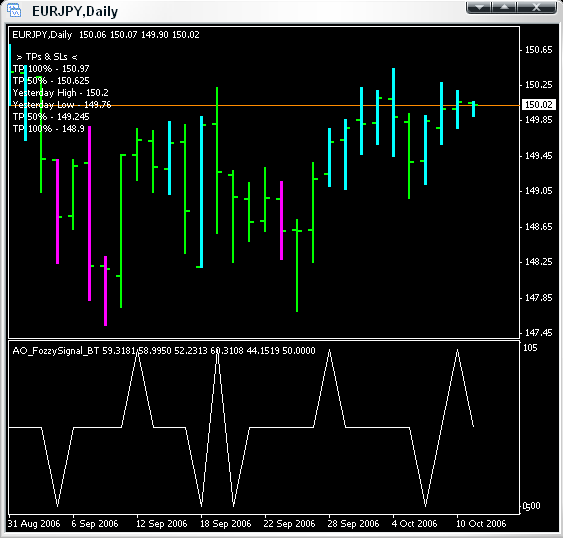

My summation: an 8 Period RSI is plotted with an 8 period MA of that RSI on a daily chart. When the RSI crosses its MA either up or down, its considered a buy or sell signal. You wait until the day that the signal was generated is done before placing any orders - ie, you don't place an order just because a cross starts to appear, you wait for it to solidify and take action at the start of the next day.

Fozzy's orginal rules also includes plotting Bollinger Bands of the RSI and only taking buy signals that develop below the middle BB line, as well as only taking sell signals that develop above the middle BB line. Though I respect Fozzy's opinion and research, my own research thus far points me towards not employing this BB filter. The indicators that I will attach (most likely in a later post), do show the BBs for those who wish to observe Fozzy's filter.

This is a DAILY system. It hasn't been tested on smaller timeframes (by me, anyway). I have no idea if it would work well or not on smaller timeframes. The reason that I (and Fozzy as well) use these similar systems is that we've got day jobs and can't sit around watching charts all day. The idea is that this system allows you to check in at 0:00 GMT, place your market orders for the day (if any signals have developed), and walk away.

Its my opinion that any such 'fire-and-forget' system is, by default, crippled. Basically I'm trying to make the best of a bad situation. Backtesting this system on GBPUSD since the beginning of 2006 showed good results (I'll post the exact results later), so I'm forward testing it.

I'm not advocating this method. This is a research project. As I've said before, let's have an intelligent, respectful conversation, and educate each other.

My summation: an 8 Period RSI is plotted with an 8 period MA of that RSI on a daily chart. When the RSI crosses its MA either up or down, its considered a buy or sell signal. You wait until the day that the signal was generated is done before placing any orders - ie, you don't place an order just because a cross starts to appear, you wait for it to solidify and take action at the start of the next day.

Fozzy's orginal rules also includes plotting Bollinger Bands of the RSI and only taking buy signals that develop below the middle BB line, as well as only taking sell signals that develop above the middle BB line. Though I respect Fozzy's opinion and research, my own research thus far points me towards not employing this BB filter. The indicators that I will attach (most likely in a later post), do show the BBs for those who wish to observe Fozzy's filter.

This is a DAILY system. It hasn't been tested on smaller timeframes (by me, anyway). I have no idea if it would work well or not on smaller timeframes. The reason that I (and Fozzy as well) use these similar systems is that we've got day jobs and can't sit around watching charts all day. The idea is that this system allows you to check in at 0:00 GMT, place your market orders for the day (if any signals have developed), and walk away.

Its my opinion that any such 'fire-and-forget' system is, by default, crippled. Basically I'm trying to make the best of a bad situation. Backtesting this system on GBPUSD since the beginning of 2006 showed good results (I'll post the exact results later), so I'm forward testing it.

I'm not advocating this method. This is a research project. As I've said before, let's have an intelligent, respectful conversation, and educate each other.

Et ecce equus pallidus...