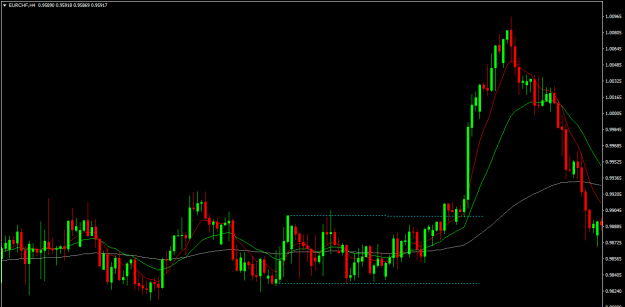

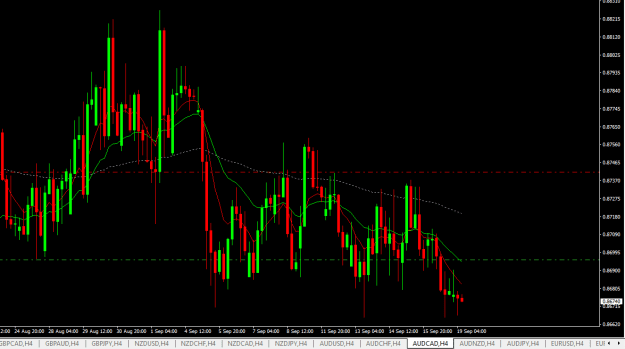

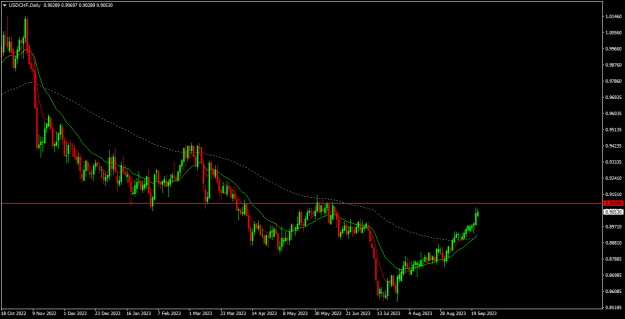

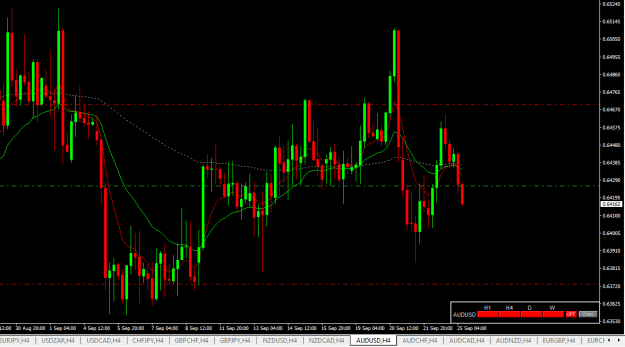

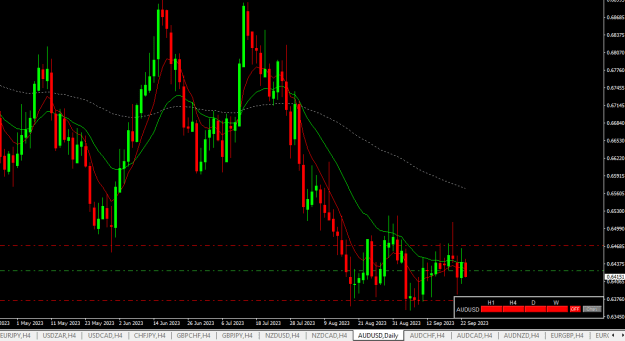

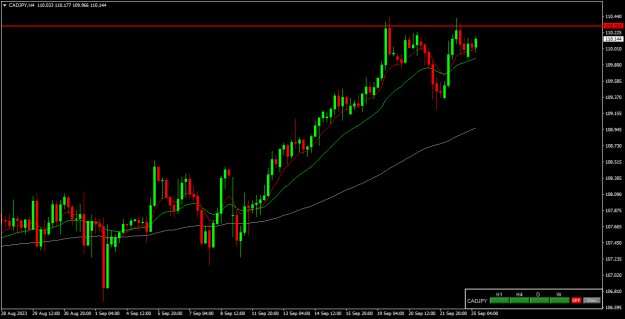

DislikedWe have a "pinch" .... my money is on a break downward. {image} {image}Ignored

- Post #1,221

- Quote

- Sep 18, 2023 2:18pm Sep 18, 2023 2:18pm

- Joined Feb 2019 | Status: Member | 435 Posts

- Post #1,222

- Quote

- Sep 18, 2023 2:43pm Sep 18, 2023 2:43pm

- Joined Feb 2019 | Status: Member | 435 Posts

- Post #1,228

- Quote

- Sep 21, 2023 2:27pm Sep 21, 2023 2:27pm

- Joined Feb 2019 | Status: Member | 435 Posts

- Post #1,229

- Quote

- Sep 21, 2023 2:35pm Sep 21, 2023 2:35pm

- Joined Feb 2019 | Status: Member | 435 Posts

- Post #1,230

- Quote

- Sep 21, 2023 2:45pm Sep 21, 2023 2:45pm

- Joined Feb 2019 | Status: Member | 435 Posts

- Post #1,231

- Quote

- Sep 21, 2023 2:54pm Sep 21, 2023 2:54pm

- Joined Feb 2019 | Status: Member | 435 Posts

- Post #1,234

- Quote

- Sep 22, 2023 8:36am Sep 22, 2023 8:36am

- | Joined Apr 2023 | Status: Member | 98 Posts

- Post #1,236

- Quote

- Sep 23, 2023 11:37am Sep 23, 2023 11:37am

- Joined Feb 2019 | Status: Member | 435 Posts

- Post #1,239

- Quote

- Sep 25, 2023 8:35am Sep 25, 2023 8:35am

- | Joined Apr 2023 | Status: Member | 98 Posts