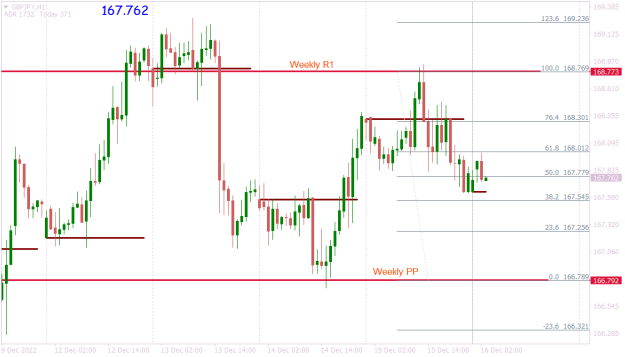

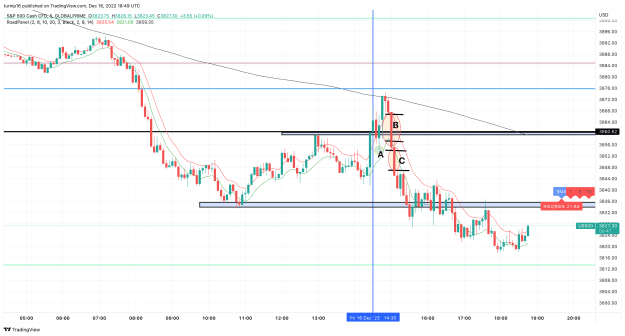

Disliked(Cheers Mark) This is the same GJ chart, but now "post news spike" as viewed this morning. This chart shows the area (still tradeble imo, as range) where the 'concept' of randomness occurs, you can call it accumulation or whatever, it doesn't matter but it is where both buyers & sellers still in the game are 'trapped' for a better word. Someone will 'cash in' & someone will 'tap out', eventually, and close during this period maybe (frustration, boredom, financial etc), and then the next 'phase' cycle can begin.Repetitive Market Behaviour & Market...Ignored

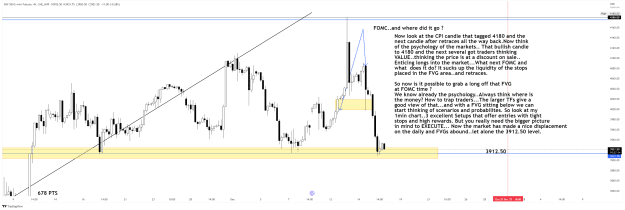

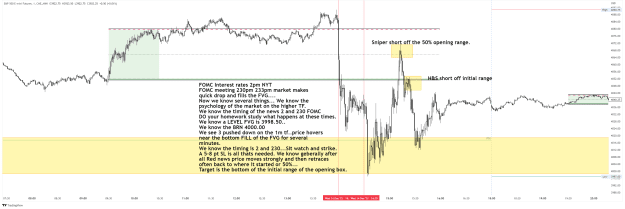

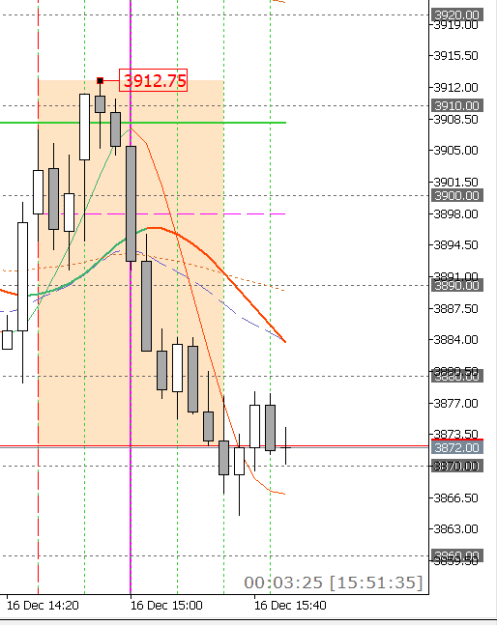

Mark ... Everything you have been told is a LIE

3