With exception to a few breakout trades/trend line trades, I have not been successful with any system other than the flying buddah system that I read about on a previous thread here. http://www.forexfactory.com/showthread.php?t=2555447

http://www.forexfactory.com/showthread.php?t=255537

While the flying buddah (fb) has about a 40% success rate according to those threads, I have found that with forex.com (or any other broker that closes at the same time), the success rate is far better but only on the Daily chart, and only on Sunday evenings.

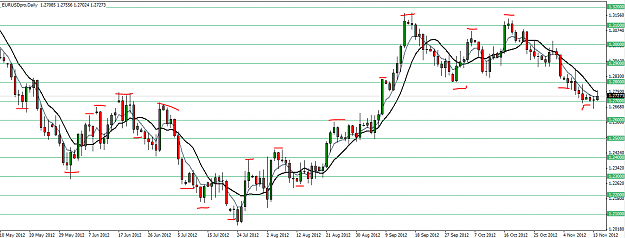

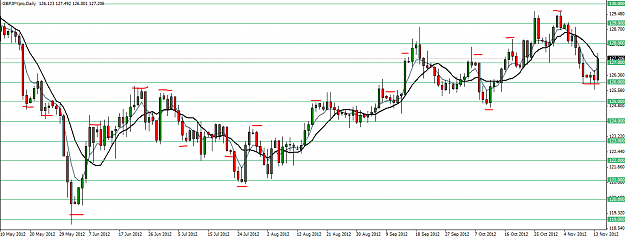

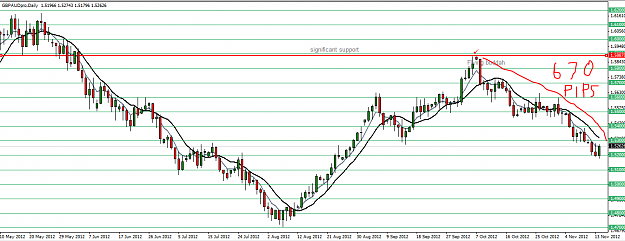

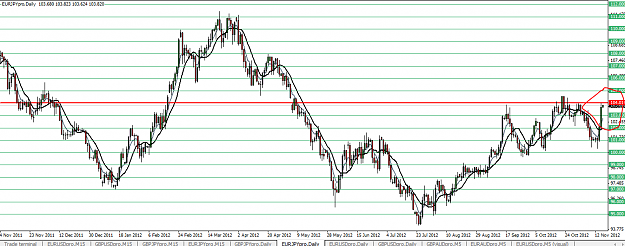

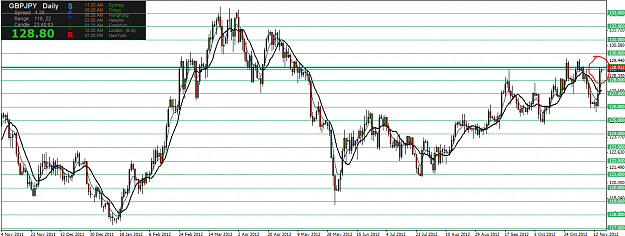

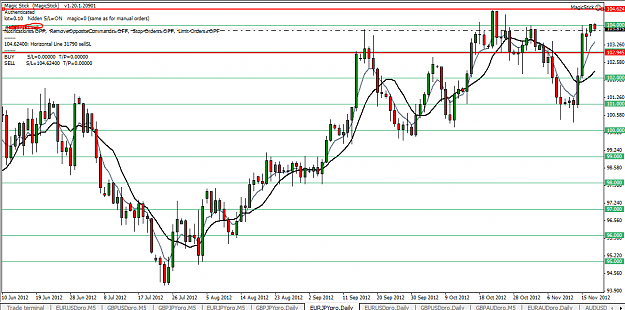

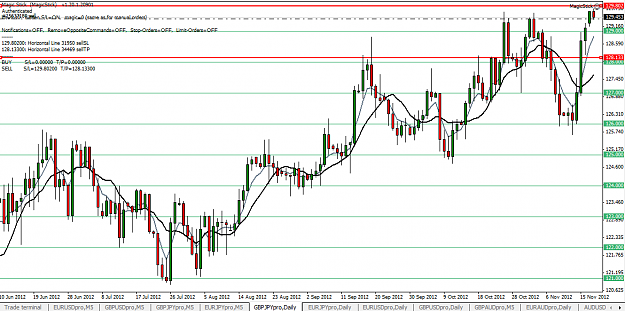

In the next 2 charts (gj and eu), you can see that any candles completely below or above the 5ema tend to signal at least a small reversal in the next few hours or the next few days. Sometimes, this reversal is far larger than small, and can be worth 100+ pips. Generally the reversal is very large when the price is oversold/overbought at a historic resistance level.

I traded this system live for 2 months with a $1000 account, and I gained about 25% on the account by trading on a few different currencies. I got out of trading at the end of June because I purchased a new house and needed all of the cash I could get, but now I'm back and working on it again.

Now 25% is not significant, but I also did not let my profits run (too much of a rookie). I took 30-60 pips a trade instead of the 100 plus pips that could occur.

Anyways, I would like to have some feedback on whether or not this trading method is that well known or used that often. Any feedback on this would be great actually. So any thoughts/ideas on this are appreciated. I will post another chart with SL in the next post

http://www.forexfactory.com/showthread.php?t=255537

While the flying buddah (fb) has about a 40% success rate according to those threads, I have found that with forex.com (or any other broker that closes at the same time), the success rate is far better but only on the Daily chart, and only on Sunday evenings.

In the next 2 charts (gj and eu), you can see that any candles completely below or above the 5ema tend to signal at least a small reversal in the next few hours or the next few days. Sometimes, this reversal is far larger than small, and can be worth 100+ pips. Generally the reversal is very large when the price is oversold/overbought at a historic resistance level.

I traded this system live for 2 months with a $1000 account, and I gained about 25% on the account by trading on a few different currencies. I got out of trading at the end of June because I purchased a new house and needed all of the cash I could get, but now I'm back and working on it again.

Now 25% is not significant, but I also did not let my profits run (too much of a rookie). I took 30-60 pips a trade instead of the 100 plus pips that could occur.

Anyways, I would like to have some feedback on whether or not this trading method is that well known or used that often. Any feedback on this would be great actually. So any thoughts/ideas on this are appreciated. I will post another chart with SL in the next post