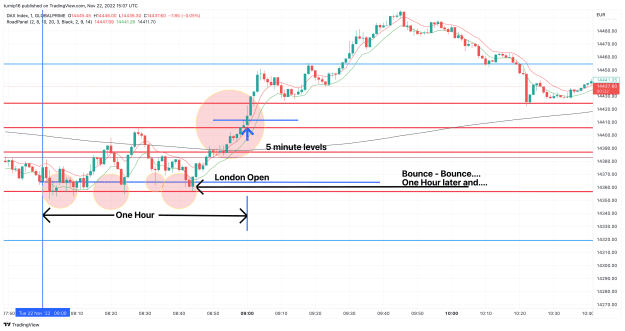

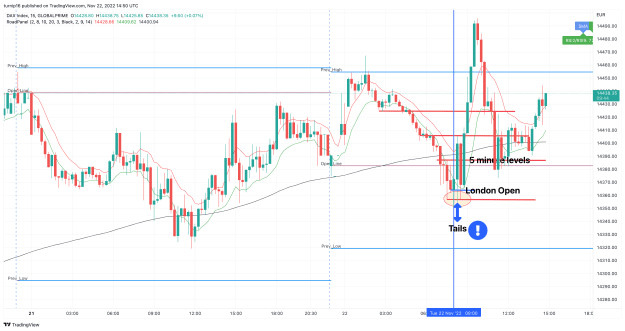

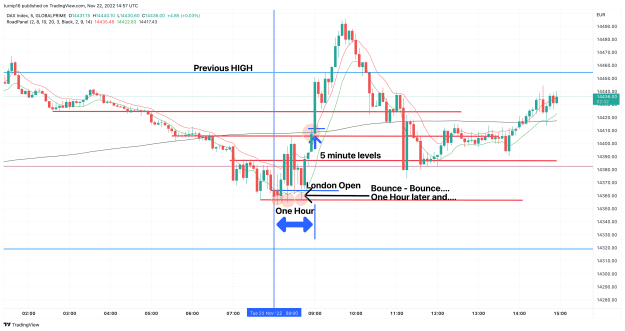

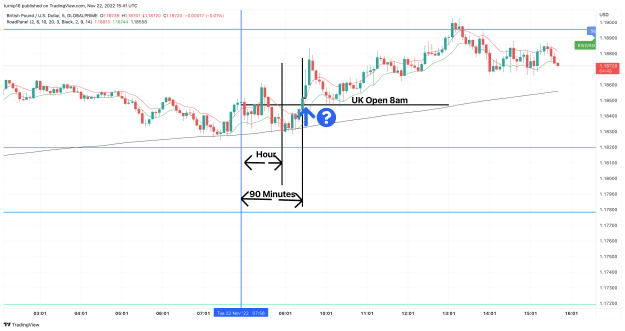

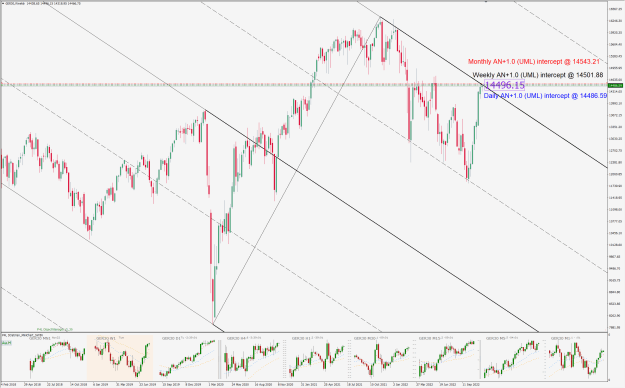

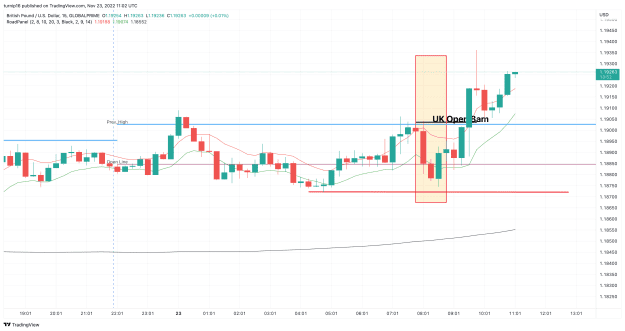

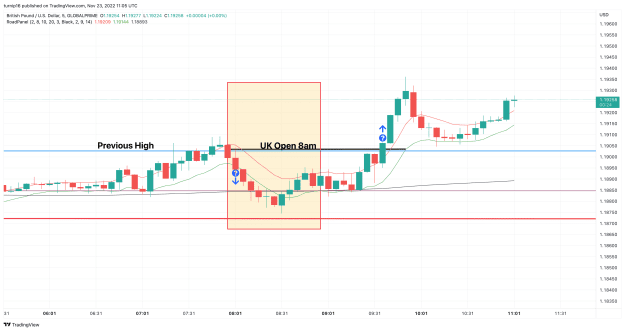

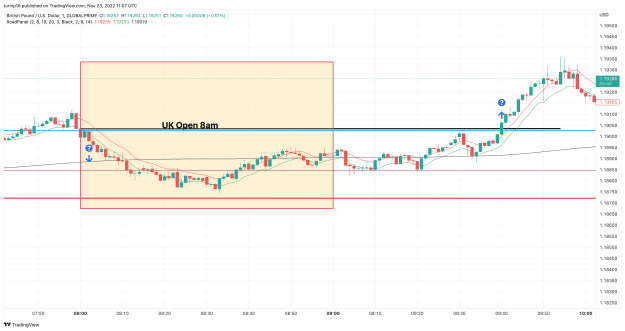

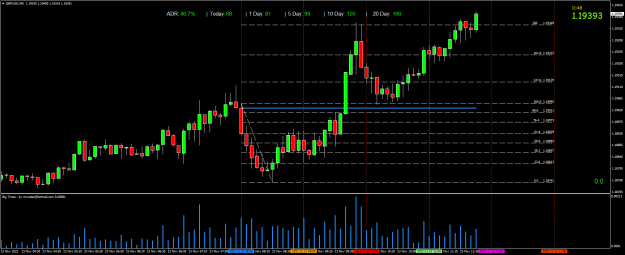

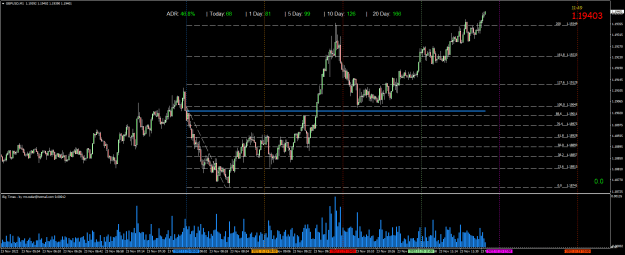

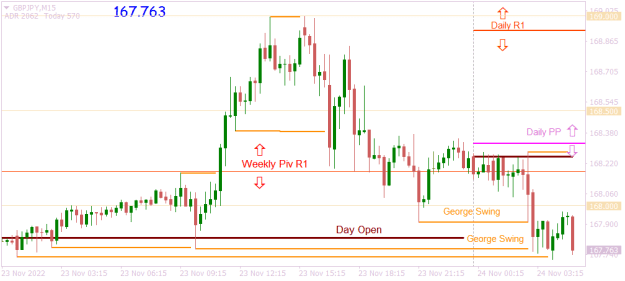

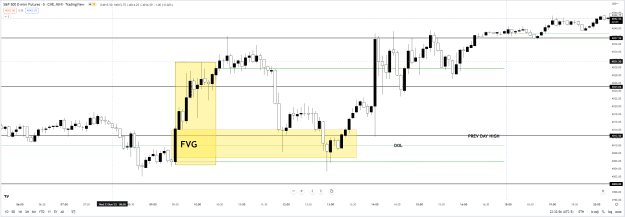

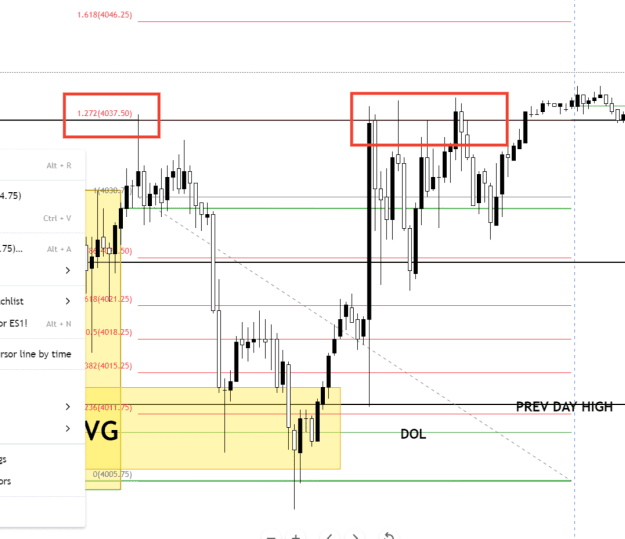

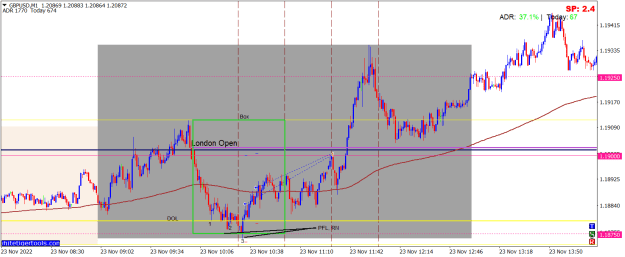

Disliked{quote} Hi T One more then I have to go.... Heres your FTSE trade setup as per Lauras Roadmap and also a PFL off prev day low and RN 7350.00 This is where drilling down from the 5 to the 1 is helpful..and most likely why Laura recommended trading indices gold oil etc off the 1.. Me I will use the 1 5 and 15 all in conjunction. for various reasons... Anyways to me IMO the safest entry is not the PFL in this situation entry off the 1m per Laura...price and 8 channel has crossed the 200 and more importantly its crossed the London open,,, Nice bullish...Ignored

Now to practice etc. and maybe enhancing my Roadmap.

every Saint has a past. Every Sinner has a Future

3