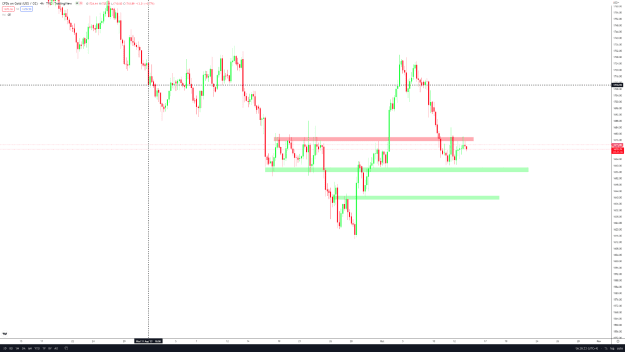

I dont trade GOLD but I used it as an indicator since major players are in these CFDs.

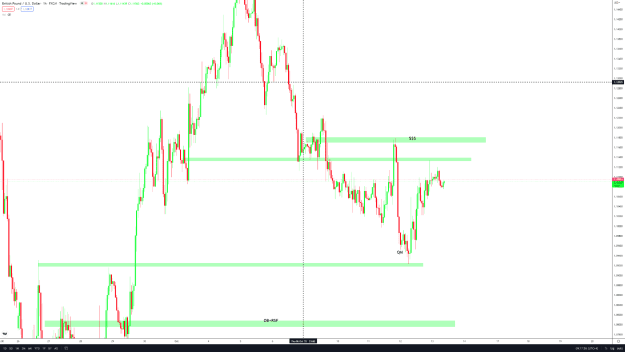

A better way to see the sentiment in the bigger picture.

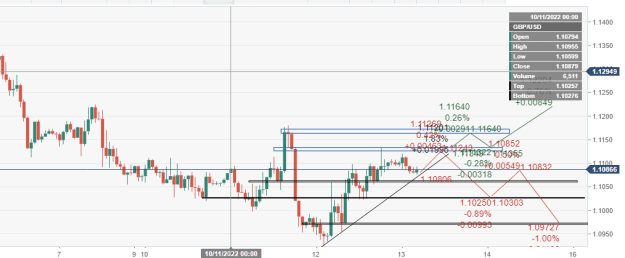

But what I see, is resistance has been respected many times, even tho 2 times BO occurred, many players placed their TP and sell orders at the same level.

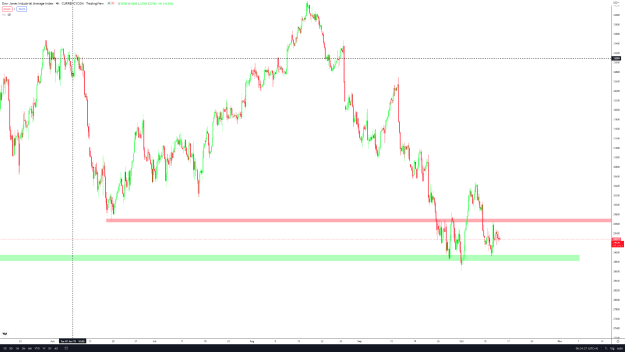

The same can be said for US30-

Support becomes Resistance and ranging for the entire yesterday= market participants dont know where we are going (Another bearish sign)

MM are accumulating rn, both in US30 and EU, we dont know where will they push for CPI, UP or down.

For me I think, it will be down.

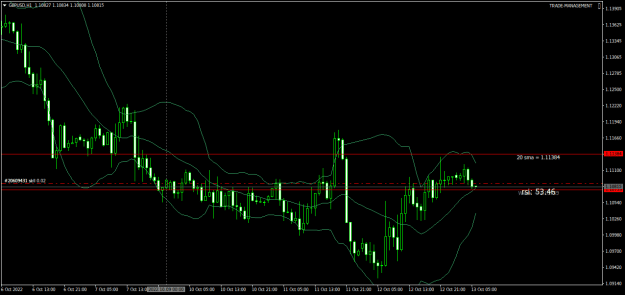

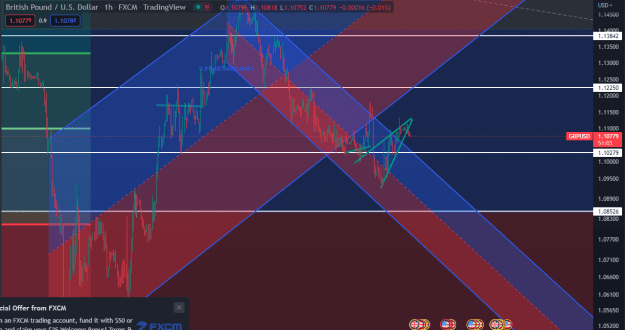

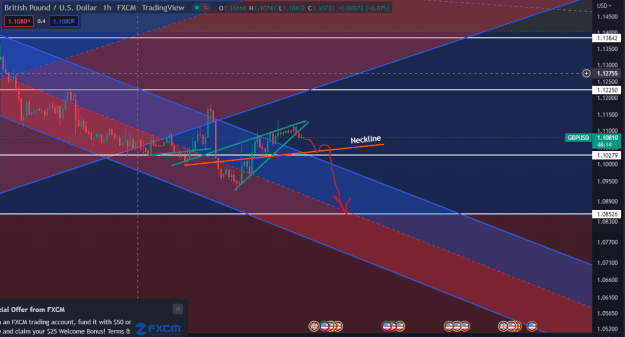

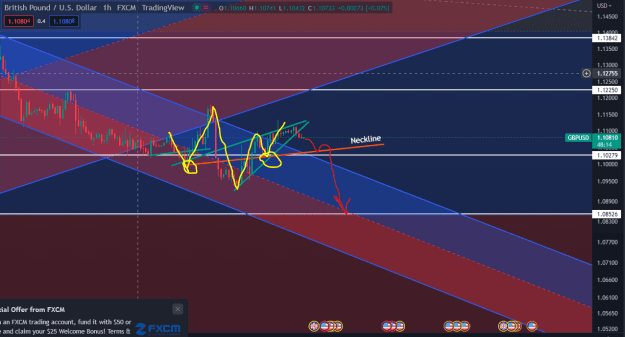

But it is better to find a good setup in GU to trade the US CPI, is the best way not to lose $$$.

A better way to see the sentiment in the bigger picture.

But what I see, is resistance has been respected many times, even tho 2 times BO occurred, many players placed their TP and sell orders at the same level.

The same can be said for US30-

Support becomes Resistance and ranging for the entire yesterday= market participants dont know where we are going (Another bearish sign)

MM are accumulating rn, both in US30 and EU, we dont know where will they push for CPI, UP or down.

For me I think, it will be down.

But it is better to find a good setup in GU to trade the US CPI, is the best way not to lose $$$.

Not afraid to be wrong, ik what am goin' to lose!

2