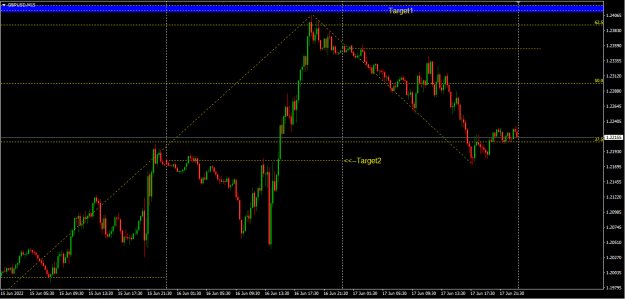

Disliked{quote} Hi Ollie, Cheers. That is how I would trade it also. I always have a near (and set in stone) Target in place (above AND below) current price. And then I also have extended Targets all along the way, so I can adjust TP on-the-fly inside the moves (not before) should the momentum runs continue. (ie sometimes I abandon the first near target and look for the 2nd etc, or sometimes even close for TP and then re-enter same trade direction after a pullback). As you say, each to their own as long as its successful in the long run. I am fortunate...Ignored

1 - I tried something, it didn't work, hence it can't work for anyone else in the universe.

2 - I've found a way that suits me, hence anyone not using that method or tools are fools that will never be profitable.

If you have the emotional intelligence to not get stuck in those mindsets (might be tough for some, depending on how they monitor their ego), then it's a good starting point.

6