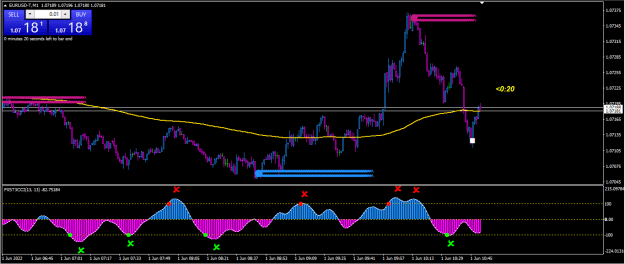

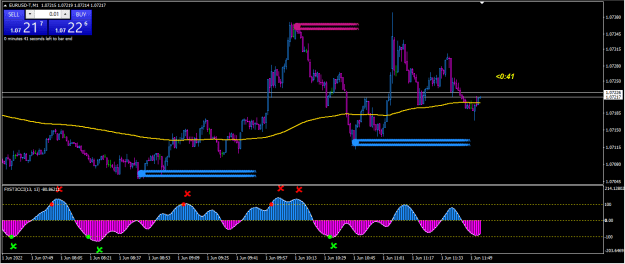

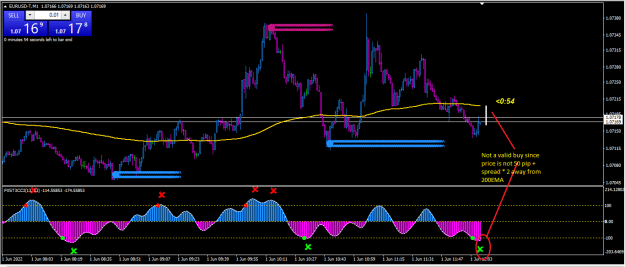

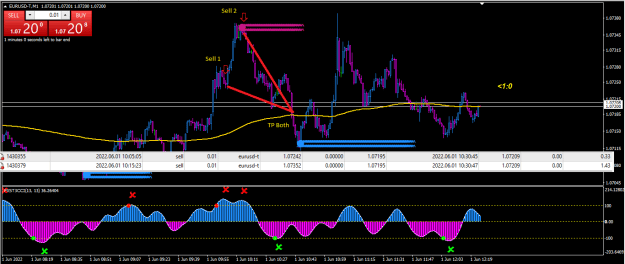

Here is a system that trades counter trend. So the counter trend is your friend until the end and then the end of the trend is still your friend.

I have tested this system manually for a lengthy time and it has an incredibly high accuracy.

I'm hoping a noble and sharing coder will write an EA for this system.

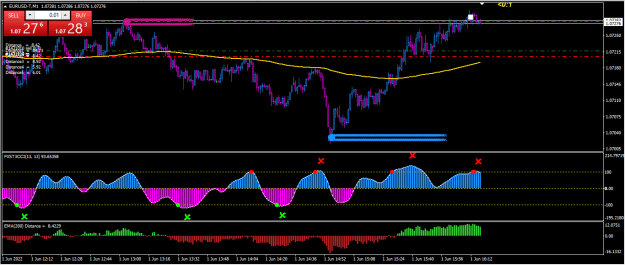

The system has been tested and developed for EURUSD M1

Rules for Buy entry:

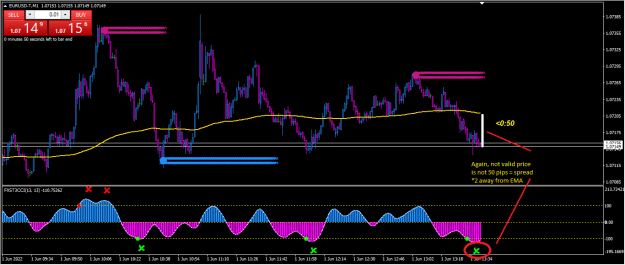

(1) Price is < 200EMA - x pips - (spread * 2)

x pips is a user input (from manual testing the minimum default for x is 50, but the better trades are greater than 80 to 100)

(2) CCI induk shows a green cross

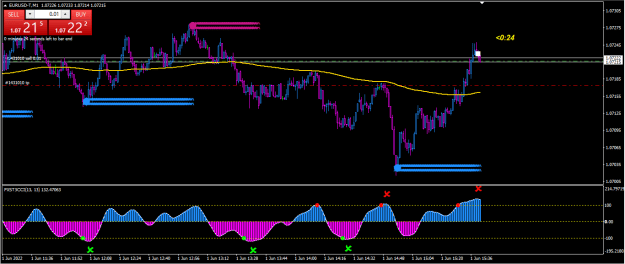

Rules for Buy Take Profit:

(1) Once an order is opened TP is immediately set at 200EMA - y pips - spread

y pips is a user input (from manual testing the minimum default for y is 15)

OR

(2) CCI induk shows a red cross and all orders are in profit

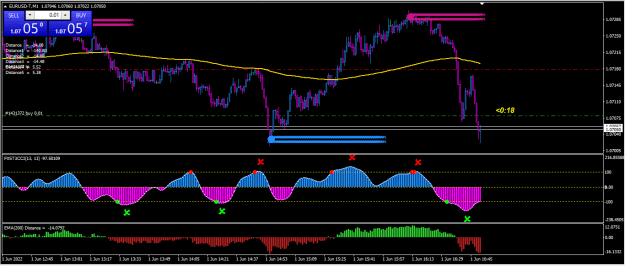

If TP is not hit and price drops further and the rules for a second Buy entry occur, then another Buy is entered with the same TP rules.

The TP is therefore adjusted upon the closing of each candle as the 200EMA is recalculated for each closed candle.

Multiple buy position can be opened in this manner (from manual experience, I have never come across more than 3).

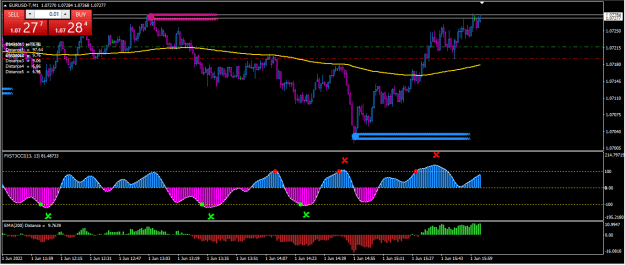

If the 200EMA moves downwards such that one of the open position becomes a loss then the TP for that position becomes a SL. In other words we may have a situation where there are three open position and TP occurs where two positions are in profit and one is in a loss. In the worst case scenario all three positions could close as SL and overall it's a loser (from manual experience I have never had this situation).

Rules for a Sell Entry:

Exact opposite to the buy entry

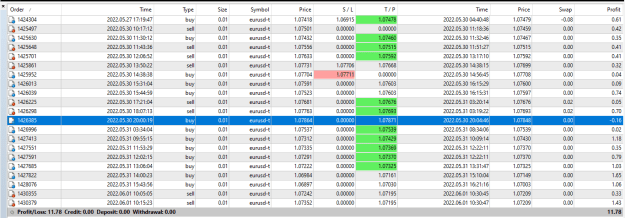

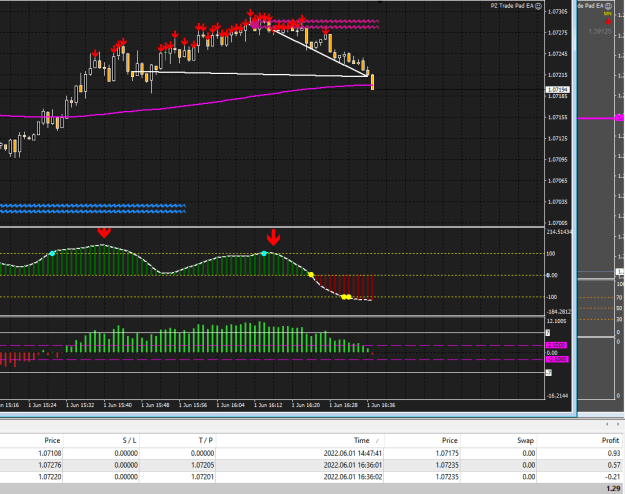

Results of this week on a live account of $130 using 0.01 lots for each trade:

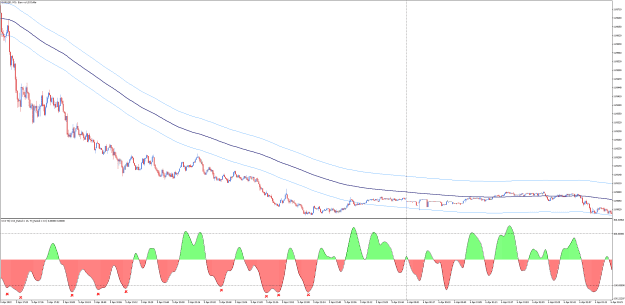

Initially one may think that this is akin to a martingale type system, but it is not since all order could be closed with a SL. Also there is no grid proposal nor is there a multiplier. The reason why it works is the 200EMA. When price moves away from the 200 average, it stands to reason that it must return to the average or the average must catch up with price, since the EMA is average price.

Here are the goods:

Comments are welcome. Good luck friends.

Edit: The Chaos Induk plays no role and is just a visual for manual trading.

I have tested this system manually for a lengthy time and it has an incredibly high accuracy.

I'm hoping a noble and sharing coder will write an EA for this system.

The system has been tested and developed for EURUSD M1

Rules for Buy entry:

(1) Price is < 200EMA - x pips - (spread * 2)

x pips is a user input (from manual testing the minimum default for x is 50, but the better trades are greater than 80 to 100)

(2) CCI induk shows a green cross

Rules for Buy Take Profit:

(1) Once an order is opened TP is immediately set at 200EMA - y pips - spread

y pips is a user input (from manual testing the minimum default for y is 15)

OR

(2) CCI induk shows a red cross and all orders are in profit

If TP is not hit and price drops further and the rules for a second Buy entry occur, then another Buy is entered with the same TP rules.

The TP is therefore adjusted upon the closing of each candle as the 200EMA is recalculated for each closed candle.

Multiple buy position can be opened in this manner (from manual experience, I have never come across more than 3).

If the 200EMA moves downwards such that one of the open position becomes a loss then the TP for that position becomes a SL. In other words we may have a situation where there are three open position and TP occurs where two positions are in profit and one is in a loss. In the worst case scenario all three positions could close as SL and overall it's a loser (from manual experience I have never had this situation).

Rules for a Sell Entry:

Exact opposite to the buy entry

Results of this week on a live account of $130 using 0.01 lots for each trade:

Initially one may think that this is akin to a martingale type system, but it is not since all order could be closed with a SL. Also there is no grid proposal nor is there a multiplier. The reason why it works is the 200EMA. When price moves away from the 200 average, it stands to reason that it must return to the average or the average must catch up with price, since the EMA is average price.

Here are the goods:

Attached File(s)

Comments are welcome. Good luck friends.

Edit: The Chaos Induk plays no role and is just a visual for manual trading.