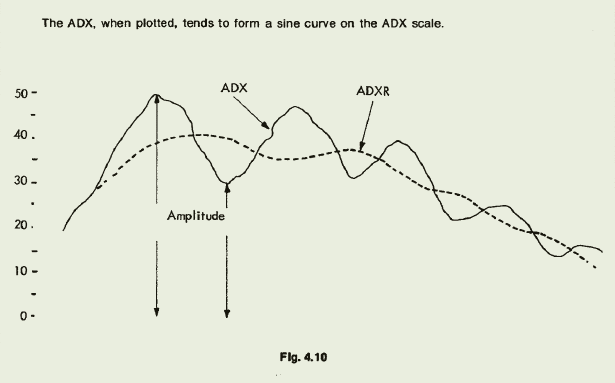

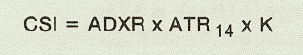

But if you thought things would be simple beyond this, you don’t know WW. He tells us that when ADXR is plotted against ADX it forms a sine wave.

Amplitude is measured from the zero line.

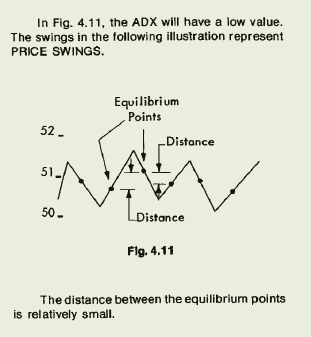

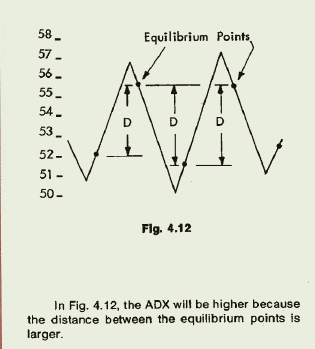

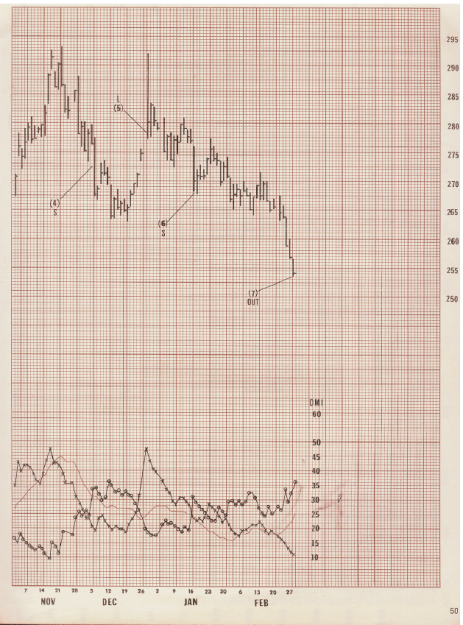

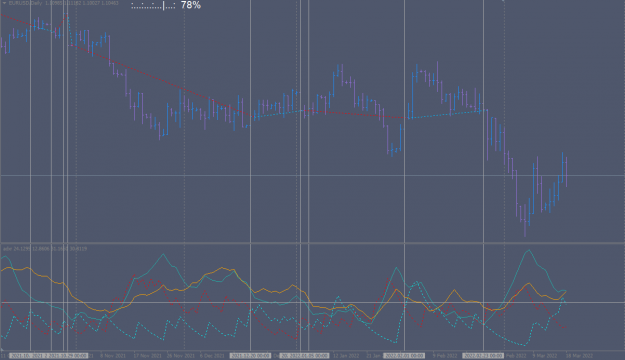

The peaks and valleys indicate a change of direction. When the trend is down the peaks are low price points and the valleys are high price points. If the trend is up, the peaks are intuitively, the high points and the valleys are low points.

The higher the amplitude the higher is the DM in on direction. The greater the distance between peaks and valleys, the greater are the reactions to the trend, which improves the chance of profitable trend following in either direction.

“The ADXR must be indicative of good directional movement but it must not overly fluctuate at equilibrium points. The directional movement concept is not the easiest concept to grasp quickly.” No kidding.

“Good directional movement is not simply straight up or straight down movement. It is also good up and down movement in excess of the equilibrium point. This is what ADX measures. The equilibrium point is reached when +DI equals -DI.

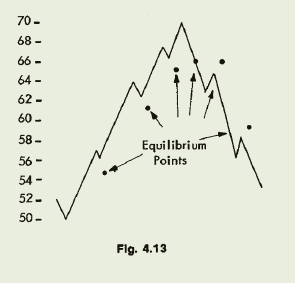

“In fig. 4.13 the ADX will have a higher value yet because the equilibrium point was only reached one time, which was the turn down."

I must confess, dear reader, that I am feeling lost. Adrift at sea. If he doesn’t bring this together in an easy to understand system I will have to leave it in your capable hands.

Luckily, it seems he does?

Next: the Directional Movement System

Amplitude is measured from the zero line.

The peaks and valleys indicate a change of direction. When the trend is down the peaks are low price points and the valleys are high price points. If the trend is up, the peaks are intuitively, the high points and the valleys are low points.

The higher the amplitude the higher is the DM in on direction. The greater the distance between peaks and valleys, the greater are the reactions to the trend, which improves the chance of profitable trend following in either direction.

“The ADXR must be indicative of good directional movement but it must not overly fluctuate at equilibrium points. The directional movement concept is not the easiest concept to grasp quickly.” No kidding.

“Good directional movement is not simply straight up or straight down movement. It is also good up and down movement in excess of the equilibrium point. This is what ADX measures. The equilibrium point is reached when +DI equals -DI.

“In fig. 4.13 the ADX will have a higher value yet because the equilibrium point was only reached one time, which was the turn down."

I must confess, dear reader, that I am feeling lost. Adrift at sea. If he doesn’t bring this together in an easy to understand system I will have to leave it in your capable hands.

Luckily, it seems he does?

Next: the Directional Movement System

2