Clemmo's Canon of Trading

1. Clemmo's First Lemma

- Simple patterns like candlesticks, MA crosses, double tops/bottoms exist in market data but anticipate nothing; they are 'fool's gold'

- The market is a pattern-erasing machine; by the time we see something it's no longer useful

- Smart people want to 'figure things out' and find order in chaos; they get stuck down rabbit holes

- Pragmatic traders just want chaos and a method of dealing with it; one method is enough

Supporting Evidence:

- Mark Tier: Learn from the Greats. Forecasting doesn't work and diversification is neutering.

- Robert Shiller: Finance is a technology. Being very clever and good at maths are not by themselves enough to avoid making basic trading errors like staying out of a long-running bull market. Another way to say the same thing: there's more to trading than fundamental analysis.

- David Aronson: Common technical analysis methods, and simple strategies based on TA don't work.

- Nicholas Nassim Taleb: Randomness is tricksy. People are pattern-detecting machines even where none exist. The vast majority of traders and money managers are self-delusional. The rare event is where real profit lies.

- Al Brooks: When you see everything, you focus on nothing. You can make a living selling trading books as long as they are confusing enough and you repeat yourself often.

- Brent Penfold: Serious traders focus on price not indicators. Pragmatists use Dow theory, breakout, (inter)market, spread, volume and statistical analysis,

2. Clemmo's Second Lemma

- Momentum is real

- Markets have inertia; this cannot be obfuscated, distorted or manipulated beyond observation

- Trending markets tend to continue trending

- The trend is your (fair-weather) friend; use it but don't depend on it

- Avoid biases and trade what you see

Supporting Evidence:

- Jesse Lauriston Livermore: Wait for the market to react. Set some money aside. Buy rising instruments, and sell falling ones. A stock is never too expensive to rise or too cheap to fall. Complex charts and systems are suspect. Keep your own records and data.

- Nekritin&Walters: Patterns generally fail but the ones that don't fail ('Big Shadows') make use of 'big' candles, in other words momentum is the real signal.

- Omer&Lizotte: if price can move n pips it's more likely (than not) to move another n pips where n is limited to a reasonable daily range; that's because trends exist

- Laurent Bernut: rising floors and falling ceilings (not examined in this thread yet)

- Neiderhoffer & Osborne: A sequence of two moves in the same direction is more likely to be followed by a move in the same direction than by a reversal

- Jeff Cooper: A stock in motion tends to remain in motion.

3. Clemmo's Third Lemma

- Sensible Money Management is Critical

- There is much random and uncontrollable behaviour in market prices

- As a result we have to treat any system probabilistically and size positions logically

- Determine odds, payoffs and expectancy

- Use a money management system that dovetails with our trading system

- Define realistic expectations about the rate of returns, and monitor that rate

Supporting Evidence:

- Jesse Lauriston Livermore: The Great Plunger died broke or close to it. You can be a great trader and still lose the war if you don't manage your battles.

- Brent Penfold: Money Management is the key to survival. It is one of the three pillars of success along with methodology and psychology.

- Kirill Emerenko: Poor Money Management can take a positive expectancy system and ruin it. Kelly's formula is theoretically optimal.

4. Clemmo's Fourth Lemma

- Price is Cyclical

- Unfortunately this cyclicality seems to be difficult to forecast, if at all

- Using shifted/phased averages might offer some benefit in forecasting trends

- Stationary (ranging) action is possibly easier to fine-tune than wild volatility

Supporting Evidence:

- JM Hurst: The Profit Magic of Stock Transaction Timing - the 'FLD'. (not covered in the book club yet)

- Manesh Patel - the Ichimoku Kinko Hyo indicator seems to be able to avoid ranges better than any Moving Average

- John Ehlers - 'spectral dilation' causes wacky interpretations of common indicators

5. Clemmo's Fifth Lemma

- Machines are better at trading

- Although our human egos don't want to admit it, computers/robots are better at many tasks, especially repetitive ones that demand speed, and consistency

- Trading is such a task. Many of the lessons learned from other books stress the importance of acting less like a human, and more like a machine

- Rather than give up your humanity, give up your ego. Let the machine do the work, and even some of the thinking.

- Don't let the machine do ALL the thinking.

Supporting Evidence:

- Every book by Jack Schwager that showcases calm, cool, measured reactions based on a fixed framework

- Behavioural Investing by James Montier; research shows software is better at multidimensional analysis and following frameworks

6. Clemmo's Sixth Lemma

- Mean Reversion Rules the Short-Term

- 'Price Action' is at least partly market noise, 'price shocks', combined with a longer-term fundamental trend

- On timeframes less than a day, the noise outweighs the signal

- Systems that seek to profit from short-term trades benefit from mean-reversion more than from trend-following

- Such systems are best for algorithmic trading, pairs trading or statistical arbitrage

Supporting Evidence:

- Alpha Trading by Perry Kaufman; mean-reversion of 'price shocks' benefit shorter trading horizons once volatility has been adjusted or filtered

- Brent Donnelly; when there is confusion about a market move it has further to run, so by inversion, when the market is in 'default mode' it (nearly) randomly walks within a range

- Edward Thorp; Two securities one which is overbought and one oversold, can be traded together to earn a market-neutral profit

7. Clemmo's Seventh Lemma

- The Markets are a Jungle Ruled by Predators and You Are the Prey

- Markets are like ecosystems both in complexity and in how they are powered by energy from producers (the public)

- The whole system could not exist without a constant input of new money flow

- Trading against this new flow is the basic cause of market noise and the reason that 'coppering the public's bets' is so effective

- It is not paranoia to assume that your stops, your entries, or your account balance is being hunted, directly or indirectly; you are in danger

- Predators are bullies. If you’re not bullying someone, you are prey. Learn how to bully.

Supporting Evidence:

- Victor Niederhoffer; the marketplace has an ecology with predators (banks and hedge funds), herbivores (fixed income), and prey (the public)

- Market Wizards, esp. Mark Weinstein; "I wait for the exact right moment to capture my prey".

- Michael Lewis, Liar’s Poker, “it’s better to have a good jungle guide than to be clever and isolated”.

- 6 years of personal experience; when you place a trade how often does it immediately go in your favour? How often does it immediately move against you?

The next big questions: What about regression analysis, and its tools like envelopes, channels and bands? What about investing? Is trading even worthwhile compared to investment profits?

Table of Contents

Reminiscences of a Stock Operator by Edwin Lefevre--------------------------------- A (absolutely essential)

The Market Wizards (series) by Jack Schwager --------------------------------------- A (indispensable classics, praised by industry giants)

The Universal Principles of Successful Trading by Brent Penfold --------------------- A- (money management explained if not settled)

The Education of a Speculator by Victor Niederhoffer -------------------------------- A- (beautifully written if somewhat expansive and perambulatory)

The Art of Currency Trading by Brent Donnelly --------------------------------------- A- (fundamental analysis with teeth)

Fooled by Randomness by Nassim Nicholas Taleb------------------------------------- A- (entertaining and thoughtful if pessimistic)

The New Trading for a Living by Dr. Alexander Elder --------------------------------- A- (some novel insights, lots of info and maybe even a useful system)

Studies in Tape Reading by Richard Wyckoff -------------------------------------------A- (seems like wisdom; and he basically invented early TA)

Tape Reading and Market Tactics by Humphrey Neil ---------------------------------- B+ (seems like Wyckoffian sort of wisdom, but emphasis on volume)

Trade My Way by Alan Hull ------------------------------------------------------------- B+ (a couple of simple yet detailed systems makes up for a couple of dud chapters)

Trading with Ichimoku by Manesh Patel ----------------------------------------------- B+ (despite all of its flaws this might actually reveal a useful TA tool)

New Concepts in Technical Trading Systems by Welles Wilder ------------------------B+ (a classic of tech. analysis that seems about as useful the rest of TA)

Cycle Analytics for Traders by John Ehlers ---------------------------------------------B+ (a daring attempt to measure the unmeasurable)

The Trading Game by Ryan Jones -------------------------------------------------------B (popular among traders, a bit of a classic, but is it really that important?)

Evidence-Based Technical Analysis by David Aronson--------------------------------- B (educational but tiresome and ends with a whimper)

Day & Swing Trading the Currency Market by Kathy Lien ---------------------------- B (a hefty data dump with somewhat less insight than data)

Behavioural Analysis by James Montier ------------------------------------------------B (a comprehensive overview of the subject with a couple of plausible strategies)

The Winning Investment Habits of Warren Buffett and George Soros by Mark Tier- B (good general advice)

Trader Vic Methods by Victor Sperandeo ---------------------------------------------- B (A solid way to identify trend changes; a boatload of psychology)

A Man for All Markets by Edward Thorp ----------------------------------------------- B (A not overly detailed or technical introduction to the first hedge funds)

Predicting Price Action by Owens & Lizotte-------------------------------------------- B- (short but sweet)

Hedgehogging by Barton Biggs--------------------------------------------------------- B- (entertaining like Market Wizards but less informative)

The City: London and Global Power of Finance by Tony Norfield --------------------- B- (an analysis of British finance from a Marxist perspective, not about trading)

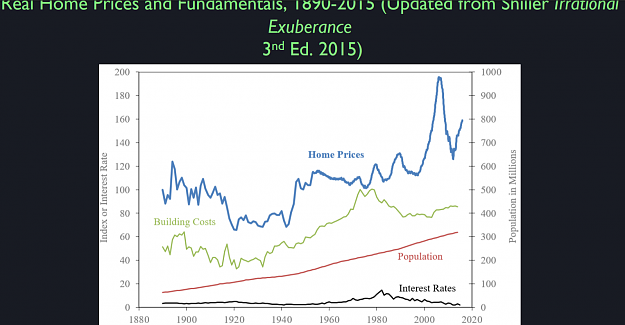

Global Financial Markets Coursera Course by Robert J Shiller------------------------- B- (somewhat academic)

The Physics of Wall Street by James Weatherall --------------------------------------- B- (good intro to history of econ modelling but modern examples are weaker)

Pit Bull by Marty Schwartz -------------------------------------------------------------- B- (good general advice, entertaining read, maybe too much like some others)

Phantom of the Pits by Art Simpson ---------------------------------------------------- B- (more good general advice, examining 2 rules basically)

Alpha Trading by Perry Kaufman ------------------------------------------------------- C+ (educational but impractical for most traders owing to highly specific methods)

The Ultimate Handbook of Forex Trading Basics & Secrets by ForexHero------------ C+ (more basics than secrets but a quick read)

Hit and Run Trading by Jeff Cooper ---------------------------------------------------- C+ (some promising ideas but barely scratches the surface)

Naked Forex by Nekritin & Walters -------------------------------------------------- C+ (some good ideas marred by imprecision)

Liar’s Poker by Michael Lewis ---------------------------------------------------------- C (A few insights but somewhat plodding)

The Successful Trader's Guide to Money Management by Andreas Unger ----------- C (lots of knowledge, but most of the credit belongs to others)

High Probability Trading Strategies by Robert Miner ---------------------------------- C (makes promises it cannot keep)

Trading From Your Gut by Curtis Faith ------------------------------------------------- C (not neuroscience or even science, and not clearly useful)

The Black Book of Forex Trading by Paul Langer -------------------------------------- C (not terrible, but far from great, just another trading book)

Reading Price Charts Bar by Bar by Al Brooks----------------------------------------- D (more useful as a cautionary tale)

Making Money in Forex by Ryan O'Keefe ---------------------------------------------- D (one interesting idea does not a good trading book make)

Bird Watching in Lion Country by Dirk Du Toit----------------------------------------- D (some fresh ideas poorly detailed and almost unreadable)

Trading Against the Crowd by John Summa ------------------------------------------- D (a mad scientist experiments with options to forecast sentiment)

Technical Analysis for the Trading Professional by Constance Brown ----------------- F (deliberately misleading. the goal is to sell books & courses)

Time Compression Trading by Jason Alan Jankovsky ---------------------------------- F (maybe I should have stuck it out but it seems an unclothed emperor to me)

Trade Your Way to Financial Freedom by Van K. Tharp -------------------------------- (skipping it as the short summary here has everything you need to know IMO)

Swimming with Sharks by Joris Luyendijk ---------------------------------------------- (journalistic commentary, not trading advice)

Please vote in the poll or suggest new books to add to the reading stack!