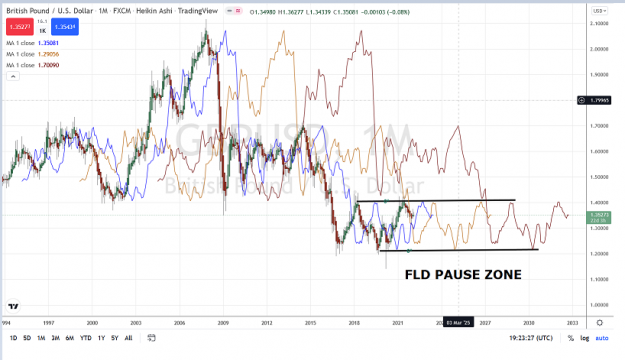

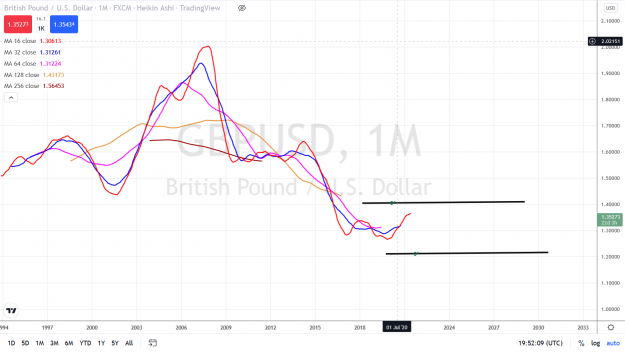

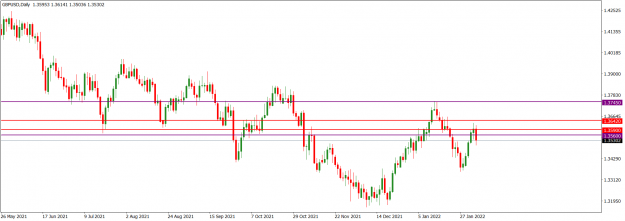

Disliked{quote} What is MN1 and MN2? Month 1, Month 2? I am going by the definition of a trend as being a sequence of higher highs and higher lows (up trend) or A sequence of lower highs and lower lows (Down trend) Attached, is the GBPUSD larger timeframe down trend. Where is the Larger TF uptrend? {image}Ignored

2