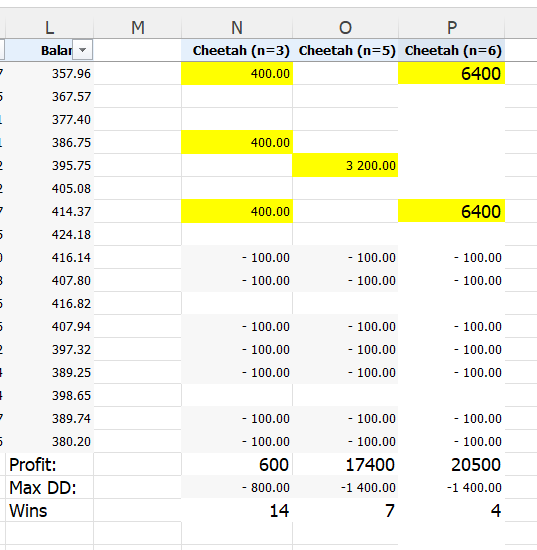

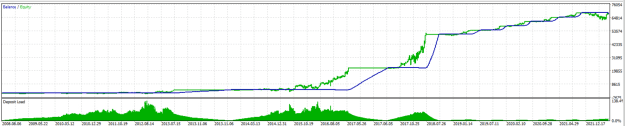

think for cheetah better focus on n>5.. money then accumulates very fast with compounding:

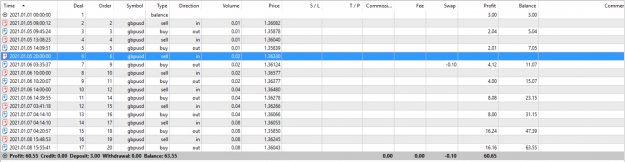

here one result for GBPUSD with n=8: start with 3 usd and then in 8 deals made 60 usd profits

here one result for GBPUSD with n=8: start with 3 usd and then in 8 deals made 60 usd profits