Hi Fellow Traders, i am not going to say all the blah blah of who am i and how did i came up with the system, or how many pips the system makes per month, all i can say is that i make constant nice profits with it, so the success will depend on each of you guys, besides, english is no my primary language and I am lazy writing, enough!!!

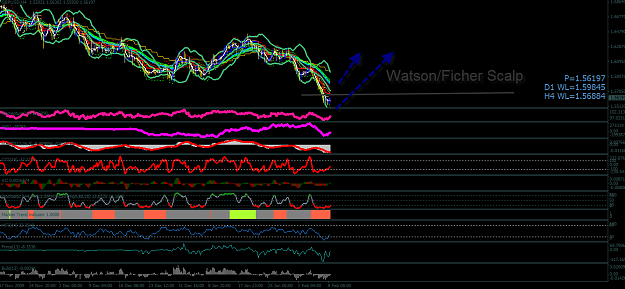

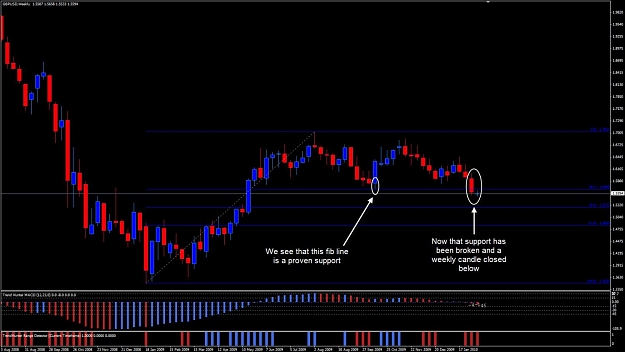

Let's get into action: please load the attached indis and template and try to digest it, the chart is pretty self explanatory but dont try to jump into any trades yet, I dont have time right now, in the next post ill write the rules, cheers!

Let's get into action: please load the attached indis and template and try to digest it, the chart is pretty self explanatory but dont try to jump into any trades yet, I dont have time right now, in the next post ill write the rules, cheers!

Attached File(s)