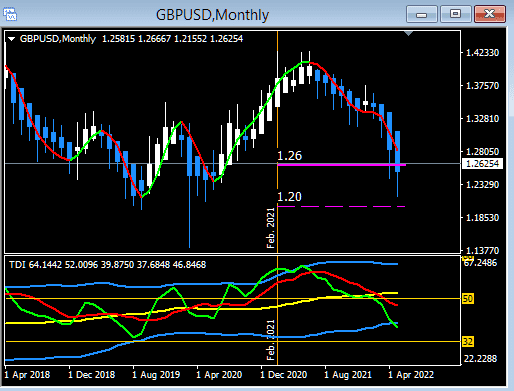

GBPUSD

As mentioned above, the H4 went into a pullback, so IMT traders were monitoring lower TFs, looking either for the buy continuations or merely watching as price continued down.

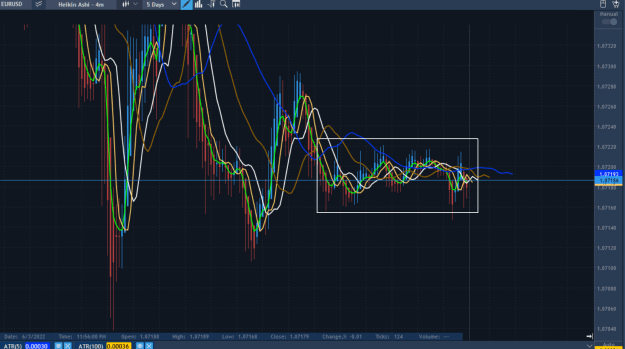

As happens with all swings, they eventually stop.

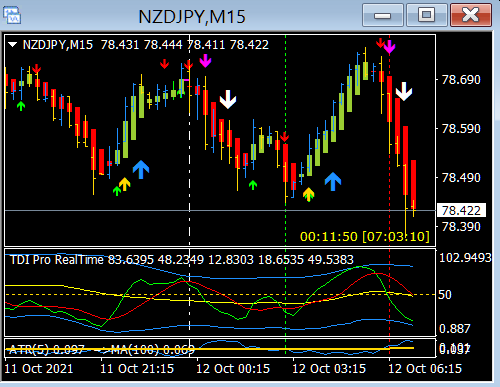

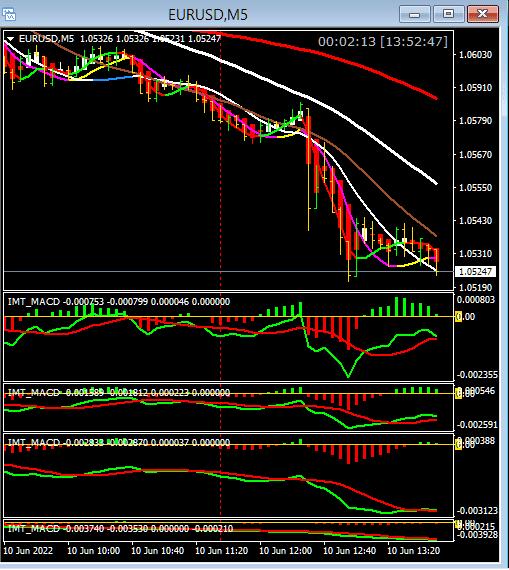

On the M15, we see clearly the previous S/R zone that needs to be broken for a buy to have higher probability of ending in profit. By having multiple TFs available, IMT traders found the buy opportunity on M5 during the marked M15 bar.

As mentioned above, the H4 went into a pullback, so IMT traders were monitoring lower TFs, looking either for the buy continuations or merely watching as price continued down.

As happens with all swings, they eventually stop.

On the M15, we see clearly the previous S/R zone that needs to be broken for a buy to have higher probability of ending in profit. By having multiple TFs available, IMT traders found the buy opportunity on M5 during the marked M15 bar.

To free Gazans of Hamas, use whatever it takes.