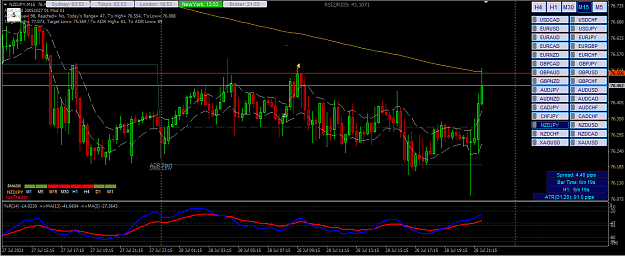

Here I exited before the stop loss manually, because the price broke through the channel in the other direction and the daylight showed the same direction (the slow MA crossed -50, and the fast one crossed the slow one).

Do you see what happened next? He mocked me. =))

Do you see what happened next? He mocked me. =))