Only an idiot knows with certainty to where the market is going.

- Post #1,195,961

- Quote

- Jun 16, 2021 1:42pm Jun 16, 2021 1:42pm

- Joined Aug 2018 | Status: Member | 2,611 Posts

- Post #1,195,962

- Quote

- Edited 5:13pm Jun 16, 2021 1:45pm | Edited 5:13pm

- Joined Jan 2012 | Status: Member | 1,416 Posts | Online Now

- Post #1,195,963

- Quote

- Jun 16, 2021 1:48pm Jun 16, 2021 1:48pm

- Joined Jun 2009 | Status: Member | 1,730 Posts

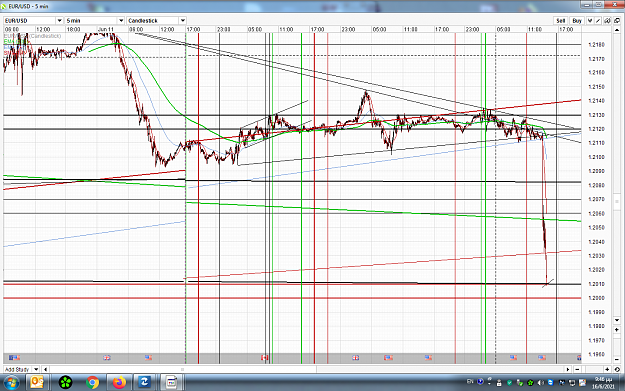

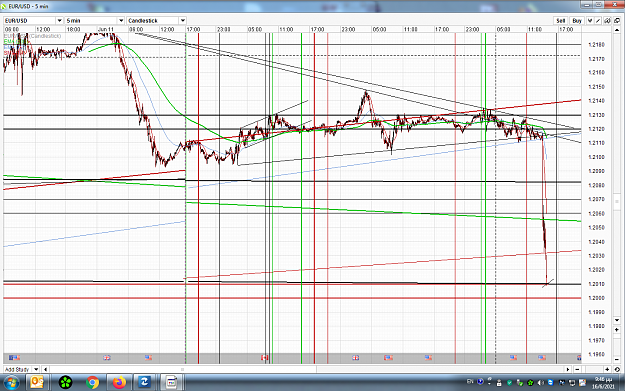

MY GRID. Markets are NOT random.

- Post #1,195,964

- Quote

- Jun 16, 2021 2:14pm Jun 16, 2021 2:14pm

- Joined Aug 2018 | Status: Member | 2,611 Posts

Only an idiot knows with certainty to where the market is going.

- Post #1,195,965

- Quote

- Jun 16, 2021 2:21pm Jun 16, 2021 2:21pm

- Joined Jan 2012 | Status: Member | 1,416 Posts | Online Now

- Post #1,195,966

- Quote

- Edited 9:37pm Jun 16, 2021 2:27pm | Edited 9:37pm

Long term profits are inversely proportional to leverage

- Post #1,195,967

- Quote

- Jun 16, 2021 2:34pm Jun 16, 2021 2:34pm

- Joined Aug 2016 | Status: Member | 7,271 Posts

- Post #1,195,968

- Quote

- Edited 2:56pm Jun 16, 2021 2:38pm | Edited 2:56pm

- Joined Feb 2016 | Status: Member | 113 Posts

The biggest risk is not taking a risk.

- Post #1,195,969

- Quote

- Jun 16, 2021 2:39pm Jun 16, 2021 2:39pm

- Joined Jun 2018 | Status: An ordinary brother | 4,270 Posts

- Post #1,195,970

- Quote

- Jun 16, 2021 2:42pm Jun 16, 2021 2:42pm

- Joined Jan 2012 | Status: Member | 1,416 Posts | Online Now

- Post #1,195,971

- Quote

- Jun 16, 2021 2:44pm Jun 16, 2021 2:44pm

- | Membership Revoked | Joined Jul 2020 | 7,294 Posts

- Post #1,195,972

- Quote

- Jun 16, 2021 2:48pm Jun 16, 2021 2:48pm

- Joined Aug 2016 | Status: Member | 7,271 Posts

- Post #1,195,973

- Quote

- Jun 16, 2021 3:02pm Jun 16, 2021 3:02pm

- Joined Aug 2018 | Status: Member | 2,611 Posts

Only an idiot knows with certainty to where the market is going.

- Post #1,195,974

- Quote

- Jun 16, 2021 3:05pm Jun 16, 2021 3:05pm

- Joined Aug 2018 | Status: Member | 2,611 Posts

Only an idiot knows with certainty to where the market is going.

- Post #1,195,975

- Quote

- Jun 16, 2021 3:07pm Jun 16, 2021 3:07pm

- Joined Dec 2019 | Status: still here | 5,378 Posts

You don't know because you don't ask.

- Post #1,195,976

- Quote

- Edited 3:43pm Jun 16, 2021 3:29pm | Edited 3:43pm

- Joined Jan 2012 | Status: Member | 1,416 Posts | Online Now

- Post #1,195,977

- Quote

- Jun 16, 2021 3:32pm Jun 16, 2021 3:32pm

- Joined Aug 2018 | Status: Member | 2,611 Posts

Only an idiot knows with certainty to where the market is going.

- Post #1,195,978

- Quote

- Jun 16, 2021 3:36pm Jun 16, 2021 3:36pm

Long term profits are inversely proportional to leverage

- Post #1,195,979

- Quote

- Jun 16, 2021 3:48pm Jun 16, 2021 3:48pm

- Joined Jan 2012 | Status: Member | 1,416 Posts | Online Now

- Post #1,195,980

- Quote

- Jun 16, 2021 3:50pm Jun 16, 2021 3:50pm

Long term profits are inversely proportional to leverage