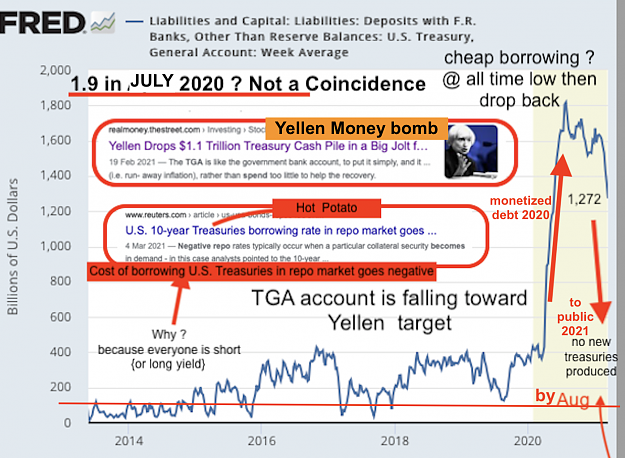

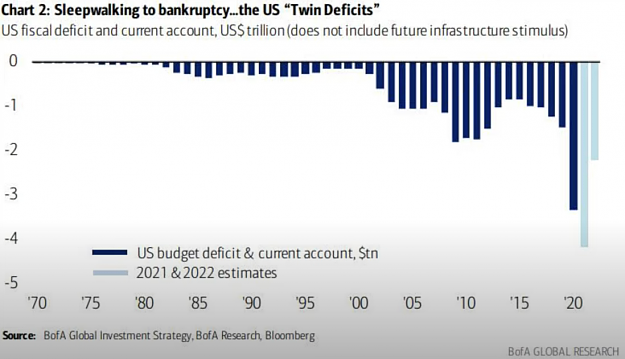

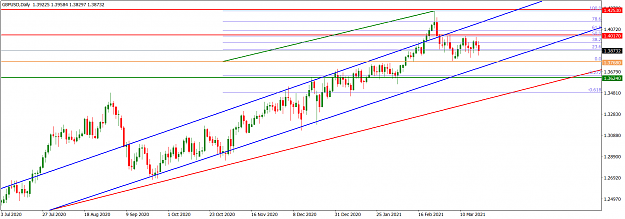

....Quite a lot of U.s bond auctions (maturities) this upcoming week...5yr on Weds, and 7yr on Thurs, and we all know what happened last time 7 year paper was offered? Be good to keep an eye on it. I can't see Powell's comments this week altering much from the policy of '...we're not too bothered about inflation currently and we'll keep rates near zero through 2023,' (to paraphrase.) How will the longer-dated maturities demand be? Potential for spillover / cross-flow volatility in gbpusd related instruments, (and others.)

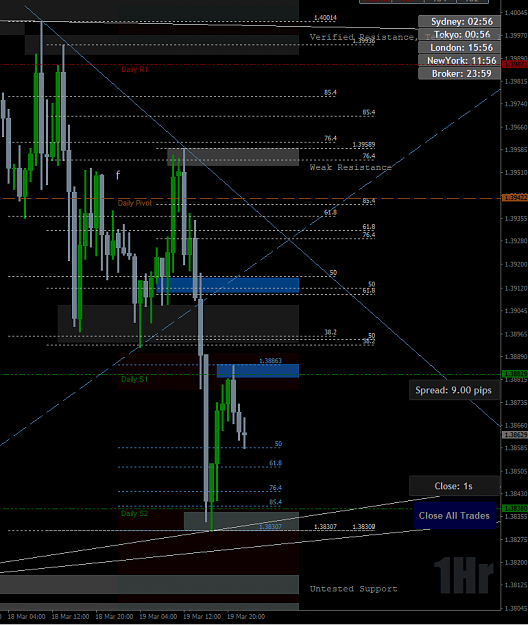

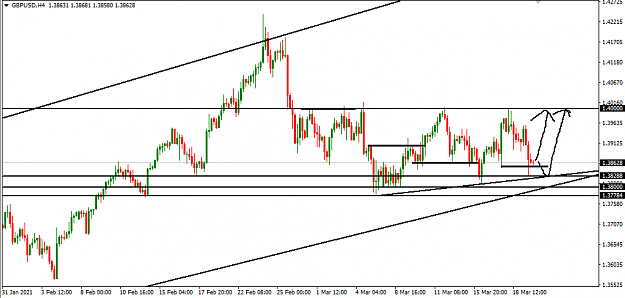

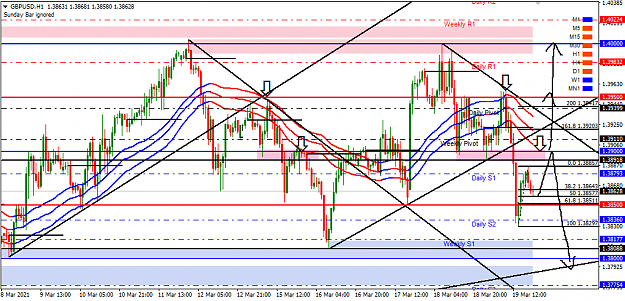

As for near-term price discovery from the Open through the Asian session and into the London session, well, like I said in my earlier post on Friday evening, who knows,? looks more bearish than bullish as of Friday close, but anything can happen. 1hr as of Friday close is below. (dly pivots shown are still Friday's - don't reset till broker opens again.)

Will the 15min bearish hidden div @ the 3886 pullback hi play out for a with downtrend (on this t/f) follow thru to a new lo below Friday's (and downtrend's last) 3830 lo?

As for near-term price discovery from the Open through the Asian session and into the London session, well, like I said in my earlier post on Friday evening, who knows,? looks more bearish than bullish as of Friday close, but anything can happen. 1hr as of Friday close is below. (dly pivots shown are still Friday's - don't reset till broker opens again.)

Will the 15min bearish hidden div @ the 3886 pullback hi play out for a with downtrend (on this t/f) follow thru to a new lo below Friday's (and downtrend's last) 3830 lo?

Intraday swing trader @ 30min+ supp/res, & 5min+ sbr/rbs, via 1min+ set-ups

1