Disliked{quote} Great advice! Thank you. Would it be rash to buy into it before market close for the weekend? (Still relatively new to this)Ignored

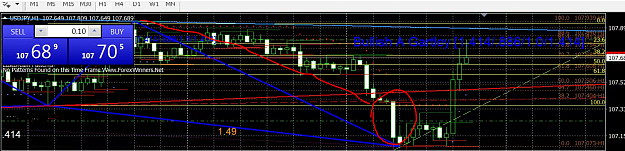

I was willing to risk buying at the bottom of the last few days' range because

- I like buying near the bottom of ranges, expecting them to hold

- I could place a very small stop-loss (just a few pips, a bit below the low of last week) while still using enough leverage to make decent $ either at the top of the range of, even better after a potential spike.

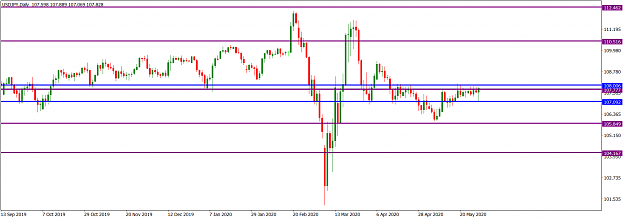

If I were to buy now, I'd be doing to in the expectation of a spike up/bullish breakout from the range, but my stop loss would have to be at the same level as before, only now that's more than 65 pips or 70 pips. For me personally, that's too big a stop loss for my usual position size.

I can and do accept such stop losses occasionally, but If I do, I reduce my position size so that the % of capital I am risking with such SLoss is no more than the % of capital I would risk with my standard position and a 15 pips stop loss.

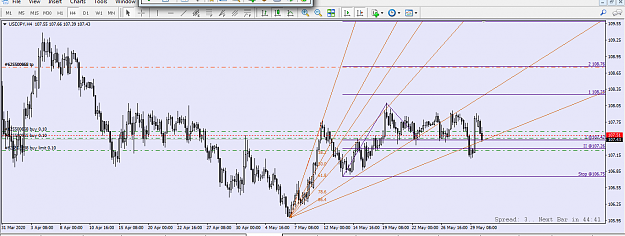

That's why personally I prefer to look for prices where I think I can use small stop losses and aim for a good risk/potential reward.

Everything begins with how much you are comfortably willing to risk, which means to potentially lose.