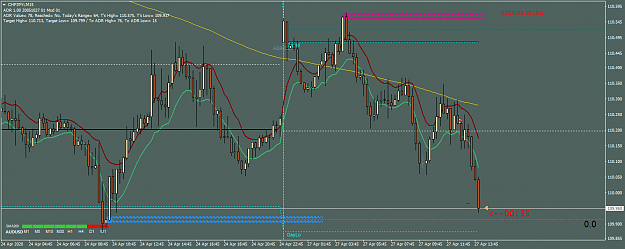

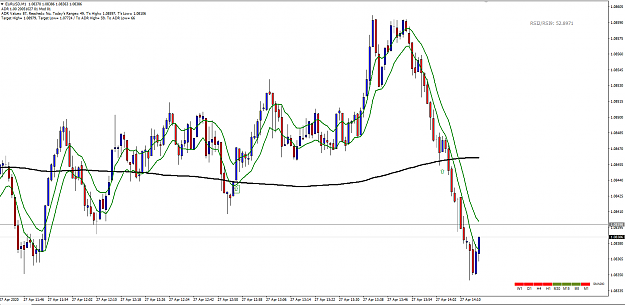

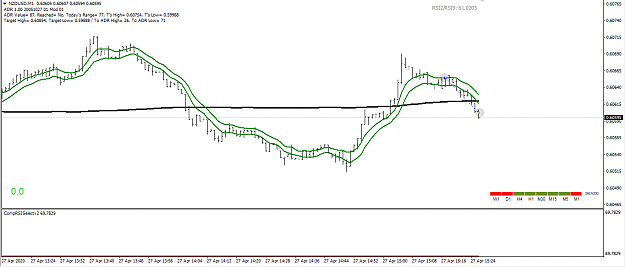

DislikedThanks for the thread, and your efforts in sharing and posting! Went short EURNZD after channel cross, all SMA's were in the red and RSI. Price reversed. Closed order. Just so I understand, was this a good setup? {image}Ignored

While backtesting I've had also many of those trades. I still have to wrap my head around those losers. Because they can produce a quite high -pip count.

I guess it's better to close the trade when one sees that the low of a bar is even above the 8EMA high. That's a strong bullish sign. Let's wait for Lauras oppinion... ;-)

1