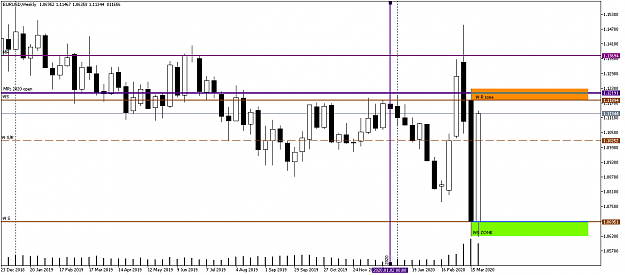

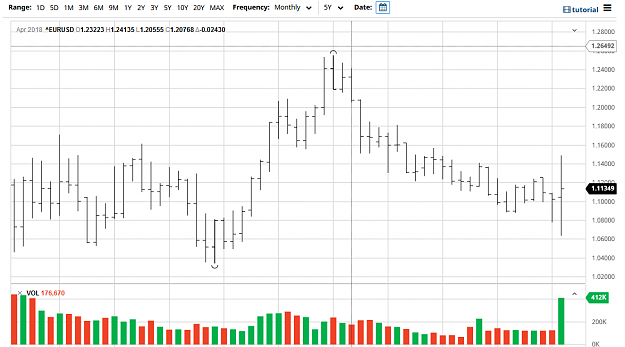

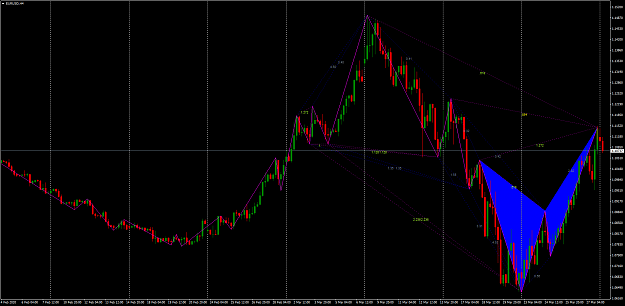

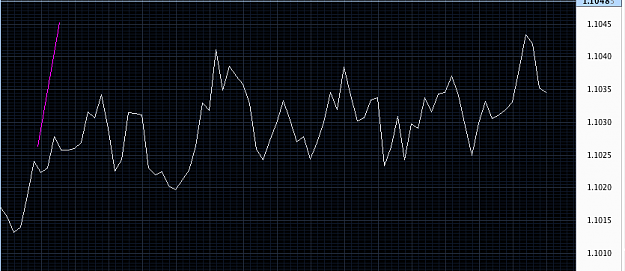

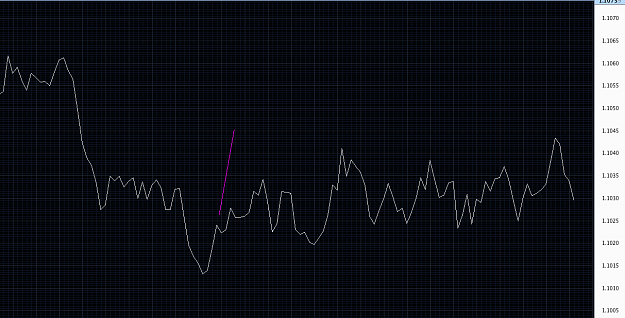

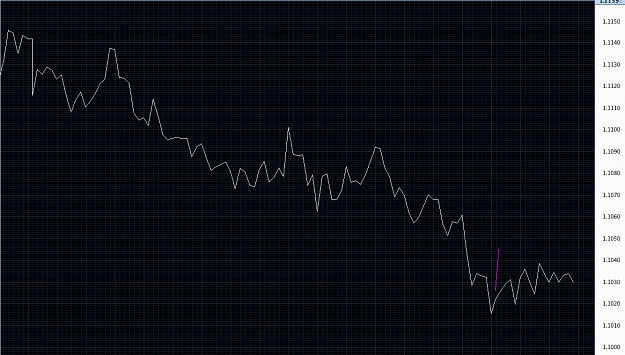

Excellent thread, keep it up! I also think we'll see swings either direction, we are in the midst of a liquidity crisis and volatility is high. The Fed has been interveening in the Repo market as lender of last resort since last October(which is misunderstood as QE and here it's about short term rates) because banks don't want to lend as the perseived risk is rising. Now, it's the end of M/Q end we are likely to see more selling and rebalancing which will put pressure on the Dow. So there is bullish momentum in the Euro but it's also hitting Monthly resistance. BWilliam is right- I'll look to see if there will be rejection at the highs.

1