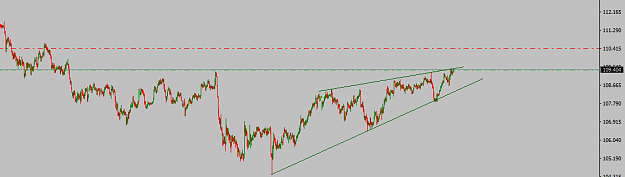

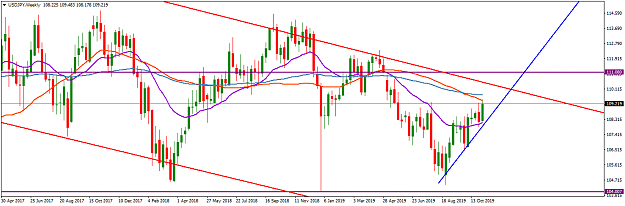

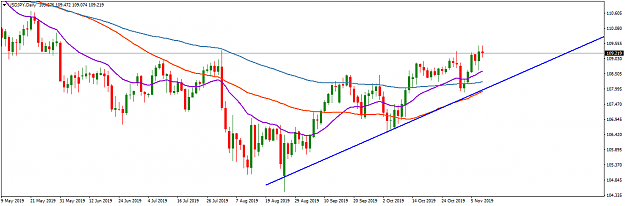

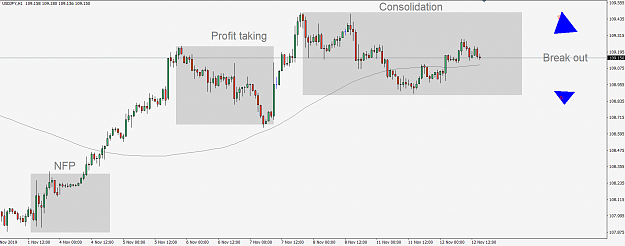

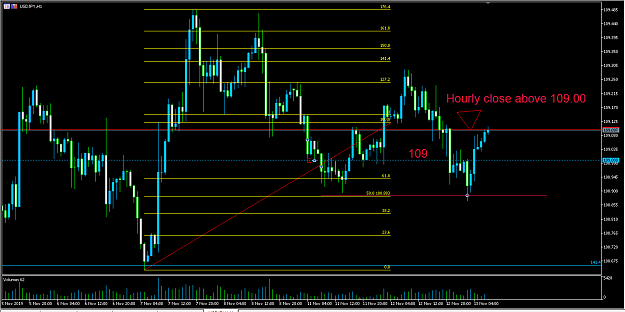

Disliked{quote} Been conflicted for days about this. This is one of the better sub threads and usd/jpy is a great pair to trade. If it weren’t for the test of last week’s high yesterday and pullback today before what could be a possible breakout from the triangle it would be easier to walk away. Are you saying people need to share ideas on the format you prefer? Let’s be honest. It is not about the 3 views this brings.Ignored

When you feel like you HAVE to trade is when you least should!

1