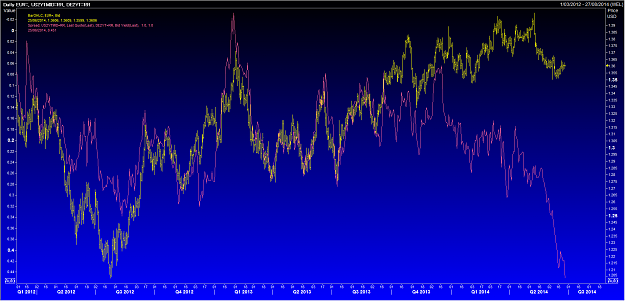

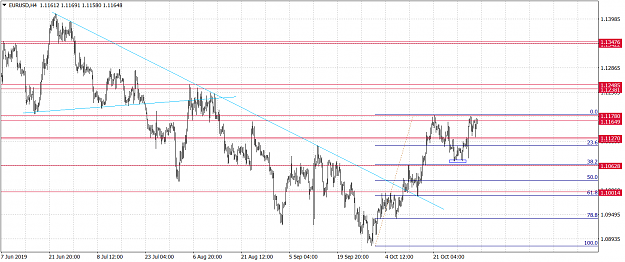

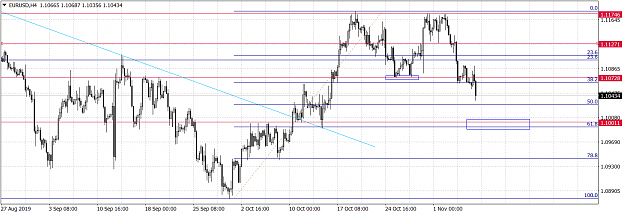

...and here's an updated chart as posted top of page of the EUR/USD over the 2 Yr interest rate differential... it's still trucking south, "Mind the Gap"

- Post #11,743

- Quote

- Jun 25, 2014 7:44am Jun 25, 2014 7:44am

- Joined May 2009 | Status: Member | 2,885 Posts

- Post #11,751

- Quote

- Oct 23, 2019 12:32pm Oct 23, 2019 12:32pm

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum

- Post #11,752

- Quote

- Oct 24, 2019 11:49am Oct 24, 2019 11:49am

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum

- Post #11,753

- Quote

- Oct 31, 2019 5:29am Oct 31, 2019 5:29am

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum

- Post #11,754

- Quote

- Oct 31, 2019 8:12am Oct 31, 2019 8:12am

- Joined Jul 2009 | Status: The Alchemist | 8,917 Posts

- Post #11,755

- Quote

- Nov 1, 2019 4:30pm Nov 1, 2019 4:30pm

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum

- Post #11,756

- Quote

- Nov 2, 2019 7:54am Nov 2, 2019 7:54am

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum

- Post #11,757

- Quote

- Nov 3, 2019 6:32am Nov 3, 2019 6:32am

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum

- Post #11,758

- Quote

- Nov 3, 2019 7:07am Nov 3, 2019 7:07am

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum

- Post #11,759

- Quote

- Nov 4, 2019 7:56am Nov 4, 2019 7:56am

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum

- Post #11,760

- Quote

- Nov 7, 2019 12:20pm Nov 7, 2019 12:20pm

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum