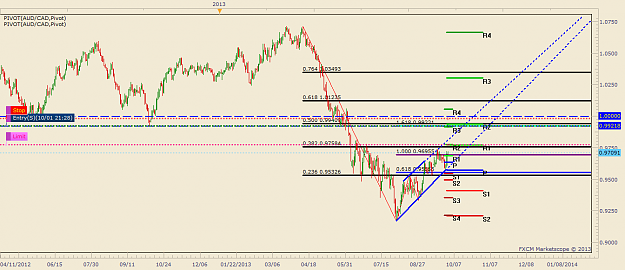

Was hoping for a retest to jump back on this, would enter on Piv. Take it to daily and you will see better what I'm talking about

- Post #11,701

- Quote

- Oct 1, 2013 11:16am Oct 1, 2013 11:16am

- Joined Jan 2010 | Status: My Coffee is Cold :( | 3,632 Posts

- Post #11,702

- Quote

- Oct 1, 2013 11:19am Oct 1, 2013 11:19am

- Joined Jan 2010 | Status: My Coffee is Cold :( | 3,632 Posts

- Post #11,703

- Quote

- Oct 1, 2013 11:22am Oct 1, 2013 11:22am

- Joined Jan 2010 | Status: My Coffee is Cold :( | 3,632 Posts

- Post #11,704

- Quote

- Edited 9:13pm Oct 1, 2013 1:40pm | Edited 9:13pm

- Joined Nov 2009 | Status: Member | 27,245 Posts

- Post #11,705

- Quote

- Oct 1, 2013 3:32pm Oct 1, 2013 3:32pm

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum

- Post #11,706

- Quote

- Oct 1, 2013 9:35pm Oct 1, 2013 9:35pm

- Joined Jan 2010 | Status: My Coffee is Cold :( | 3,632 Posts

- Post #11,707

- Quote

- Oct 1, 2013 9:36pm Oct 1, 2013 9:36pm

- Joined Jan 2010 | Status: My Coffee is Cold :( | 3,632 Posts

- Post #11,708

- Quote

- Oct 2, 2013 8:01am Oct 2, 2013 8:01am

- Joined May 2009 | Status: Member | 2,885 Posts

- Post #11,709

- Quote

- Nov 26, 2013 4:03pm Nov 26, 2013 4:03pm

- Joined Dec 2009 | Status: Nil Desperandum | 389 Posts

Nil desperandum

- Post #11,710

- Quote

- Jan 17, 2014 11:07am Jan 17, 2014 11:07am

- Joined May 2009 | Status: Member | 2,885 Posts

- Post #11,711

- Quote

- Jan 28, 2014 8:43am Jan 28, 2014 8:43am

- | Commercial Member | Joined Sep 2009 | 1,006 Posts

Find a job that you love and you dont have to work again in your life.

- Post #11,712

- Quote

- Jan 29, 2014 10:59pm Jan 29, 2014 10:59pm

- Joined May 2009 | Status: Member | 2,885 Posts

- Post #11,714

- Quote

- Jan 31, 2014 9:23am Jan 31, 2014 9:23am

- Joined Nov 2009 | Status: Member | 27,245 Posts

- Post #11,715

- Quote

- Feb 5, 2014 8:22pm Feb 5, 2014 8:22pm

- | Commercial Member | Joined Sep 2009 | 1,006 Posts

Find a job that you love and you dont have to work again in your life.

- Post #11,716

- Quote

- Feb 5, 2014 8:36pm Feb 5, 2014 8:36pm

- Joined Nov 2009 | Status: Member | 27,245 Posts

- Post #11,717

- Quote

- Feb 5, 2014 9:22pm Feb 5, 2014 9:22pm

- Joined Sep 2009 | Status: Member | 1,686 Posts

- Post #11,718

- Quote

- Feb 5, 2014 10:51pm Feb 5, 2014 10:51pm

- Joined May 2009 | Status: Member | 2,885 Posts

- Post #11,719

- Quote

- Feb 5, 2014 10:53pm Feb 5, 2014 10:53pm

- Joined May 2009 | Status: Member | 2,885 Posts

- Post #11,720

- Quote

- Feb 6, 2014 7:52am Feb 6, 2014 7:52am

- Joined May 2009 | Status: Member | 2,885 Posts