Disliked{quote} 1. I'm gonna guess that you feel qualified to define how high? 2. There are no innocent bystanders harmed when you place a losing trade. Are we to believe that your neighbor feels pain when you take a loss? 3. The industry might disagree with you. By the way, which industry?Ignored

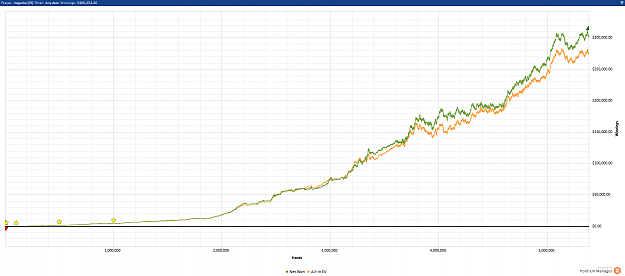

FOREX IS MANY PAIRS GOLD IS JUST ONE WHY LIMIT YOURSELF