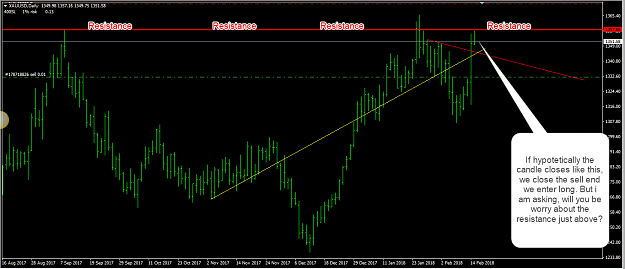

Looking better at BTCUSD, i think the yellow trendline is better than the red one, I say that because if you see the "point 1" on the chart, the first swing where i should put the trendline was too low, and making the red trendline too steep. I hope I am explaining my idea well, sorry I am not english tounge, that why i like to use screenshot with arrows and nice stuff.

So, if we base our analisys on the yellow trendline, if hypotetically speaking the daily candle close above the yellow trendline, we still don't enter long, because the actual candle is crossing the yellow TL.

If we base our analisys on the red trendline, if hypotetically speaking the daily candle close above the red trendline without crossing it, we enter long.

Really interested about your thought Ralffe,

Mirko

So, if we base our analisys on the yellow trendline, if hypotetically speaking the daily candle close above the yellow trendline, we still don't enter long, because the actual candle is crossing the yellow TL.

If we base our analisys on the red trendline, if hypotetically speaking the daily candle close above the red trendline without crossing it, we enter long.

Really interested about your thought Ralffe,

Mirko