Chapter 9 - How Leverage Increases the Potential for Forced Liquidation

Is this what you wanted to learn about? No. Me neither.

Is this what you wanted to learn about? No. Me neither.

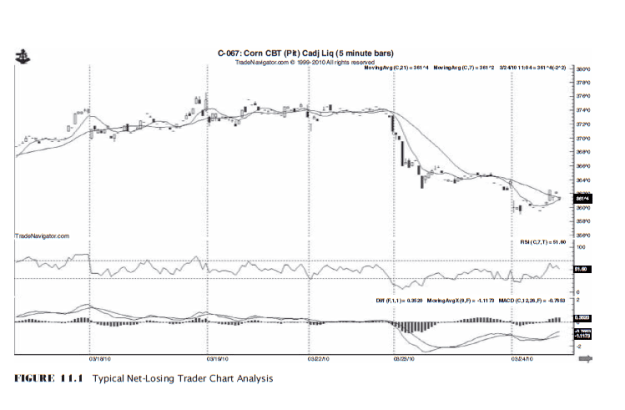

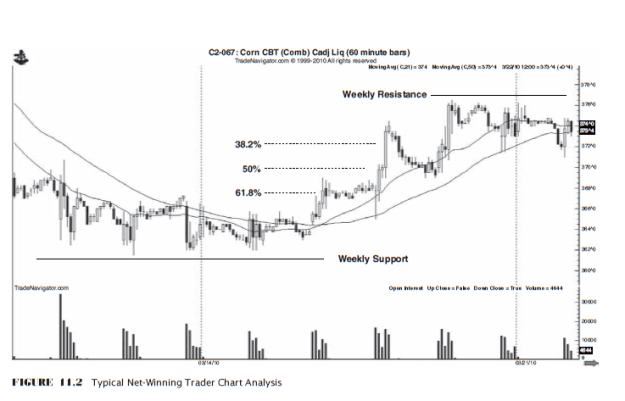

- Almost all traders use leverage incorrectly. They use too much and trade on too short a time frame.

- Leverage creates large gains and losses relative to account size.

- Nonleveraged investments often move more than leveraged ones.

JJ goes into much detail, and offers many examples of this, but this is definitely ‘stipulated’ and none of it tells us how to tell when a market price is too high or too low. Promises were made! JJ is not keeping them!

However, JJ does sum up the theory as we understand it so far, just to add a few more paragraphs to this book. Since I’m not sure if he will ever get past this point, let’s go ahead and include that.

- The markets are made of people making choices that they genuinely believe will benefit them (make money).

- These traders are relying on information and study that really isn’t based on how the market is truly constructed (entry and exit orders as they are processed).

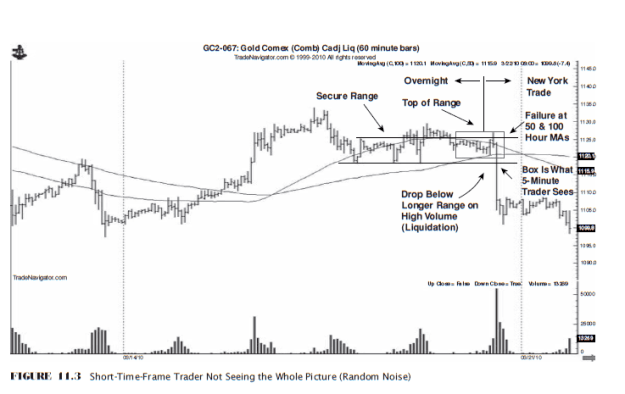

- Most traders are expecting to make money “right now.” If they don’t, they have a conflict level that they must resolve very quickly (forced liquidation).

- Because most traders are leveraging more than is reasonable for typical price action, they are likely to suffer forced liquidation very quickly (low time frames).

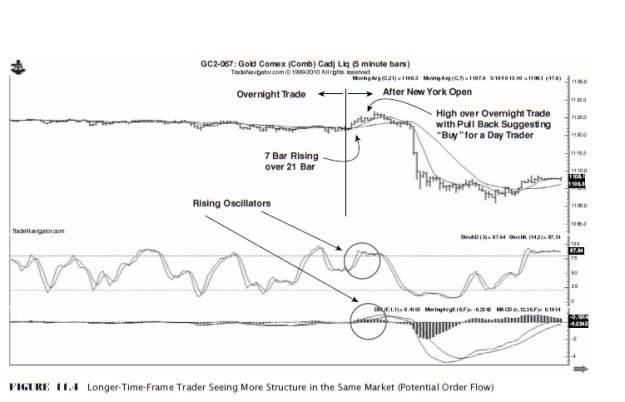

- Time compression (strong trend) is the result of a high number of traders all needing to liquidate sooner rather than later, creating a temporary order-flow imbalance.

Trader’s Life

Trade smaller and use a wider stop.

1