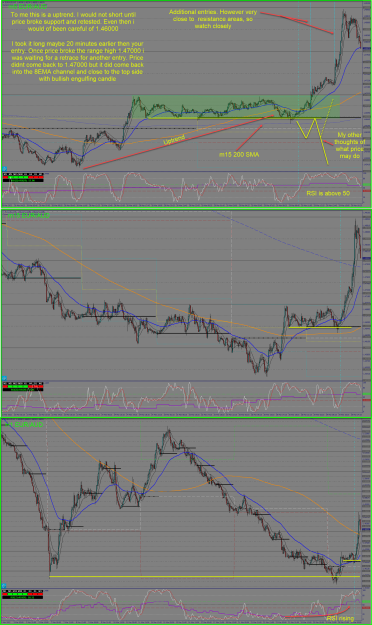

Disliked{quote} Again this is just a matter of personal preference but I'm not a fan of BE stops (even after taking partial profit). They are either put in place too quickly, and have too high a likelihood of being hit, or too slowly, resulting in giving back too much floating profit. More of an art than a science but as a general rule of thumb I would look to take partials at a logical point or in reaction to specific price behaviour. I would then check how close my stop would be to the action if I were to lock in a small profit on the remaining position....Ignored

1