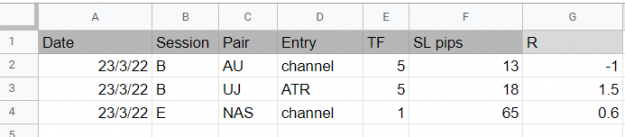

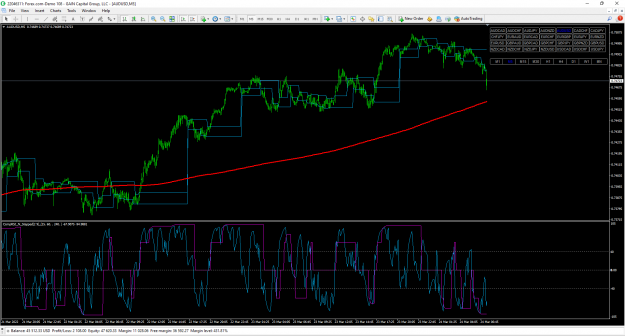

DislikedThis was the trade I lost today. I see that I should have had my SL below what would have been a clear swing low on a higher timeframe, which would have given me a winner. My question is, had I still been in the trade, would you close when it seems to hit a bit of 5M resistance like I've highlighted here. Sorry if this has been covered, but I'm only up to page 23 in slowly reading and digesting this thread. Thanks, Peter {image}Ignored

I'd likely wait a little to see if the resistance was cleared. When price revisits an area so often in such a short time, it has a decent chance of breaking through.

2