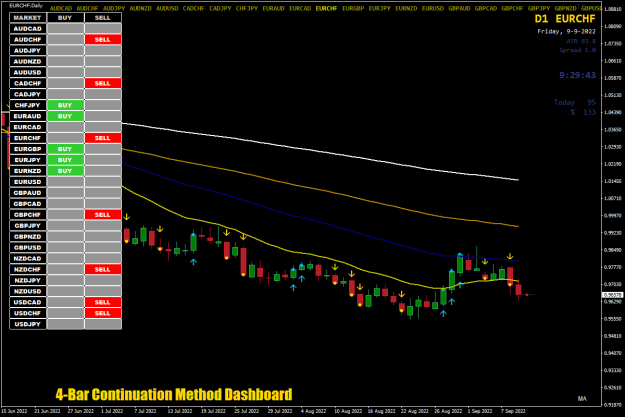

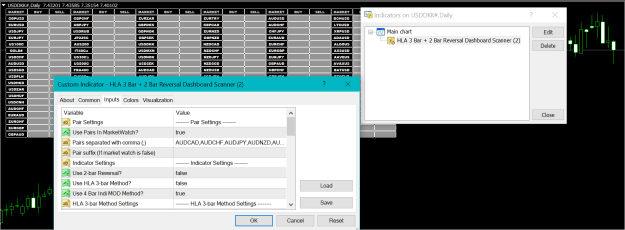

1. 4-Bar continuation

2. 3-Bar reversal

3. Inside Day

4. Pin Bar

I may or may not take a signal depending on many things, price action, news, having a bad hair day, slept in, etc.

Joking about bad hair day, I don't have any, hair that is, lots of bad days. But never any fear of missing out, take it or leave it.

For instance, didn't take anything today, just thought there might be market stall or more reversing, sure enough, some Dollar weakness.

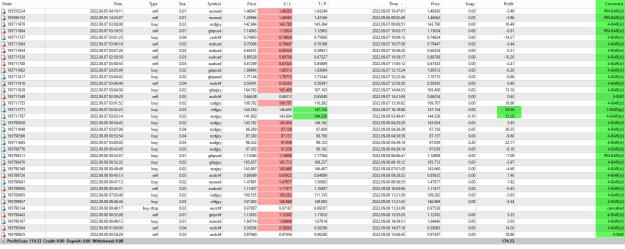

Stop Loss is 1 x ADR (10) -10 or more pips, say if it is 80 to 85, then SL is 70

Take Profit is 2 x the Stop Loss, so if it is 70, then TP is 140

Trailing Stop is immediate and the same as the Stop Loss, this is why you will see many trades stopped out for small amount.

If it moved 90 pips, and the Stop Loss and Trailing was 70, and price reversed, then it will exit at +20 pips.

Risk started at 0.01, then moved to 0.02 and now 0.03, so increase maybe at every 2 months or +$500.

It's a long and slow process, many will not be able to apply this or stay focused long enough to get results.

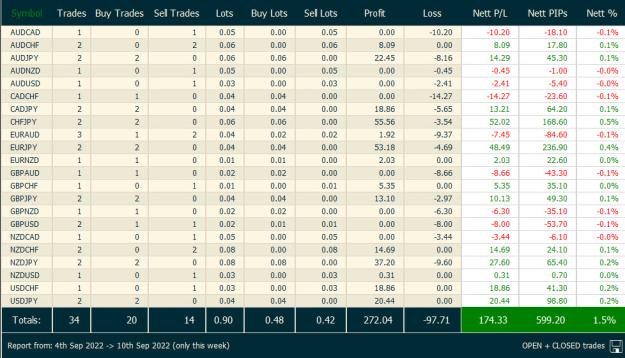

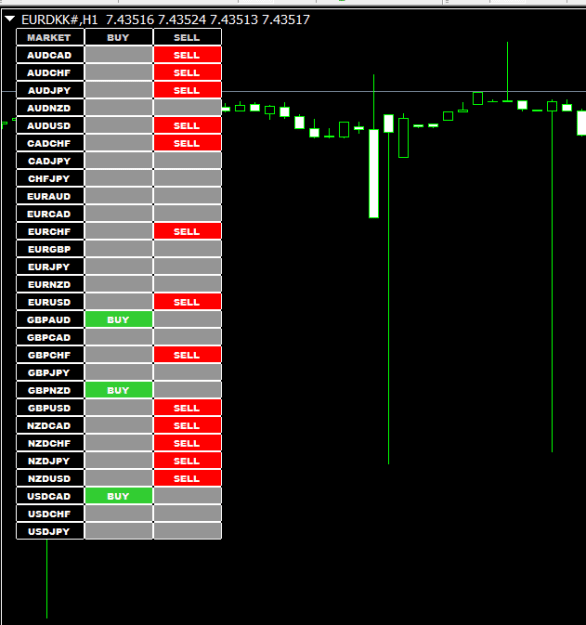

Here are this week's trades, hope that helps.

If you trade like me, you'll be homeless and broke within a week.

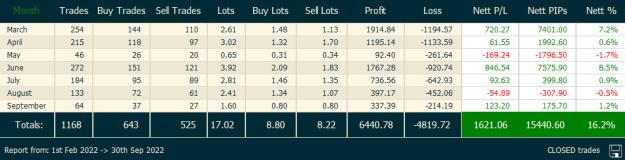

Goldilocks All Time Return:

109.1%

7