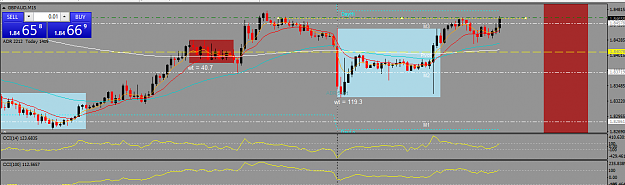

Disliked{quote} i personally keep the 14 n 100 throughout all time frames. you can also see on post 2 there was an entry on m5. why? for me it's mtf. when i see a set up in say m30, i can go to m5 for entry without changing the setting. or make the entry in m30.Ignored

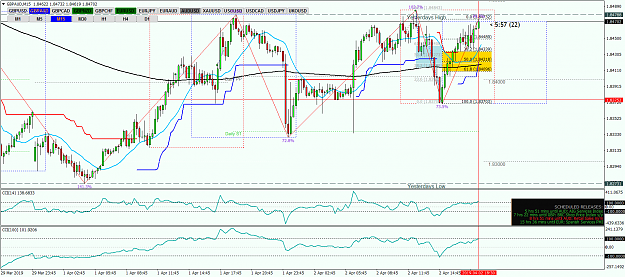

Tomorrow I'll post any trades I take, see if I can get some feedback here. I know I need to take less trades - FOMO is a difficult beast to tame!