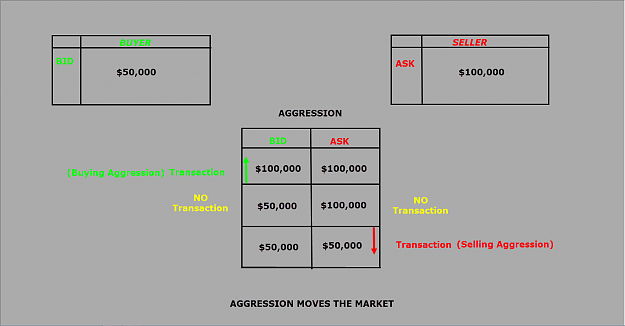

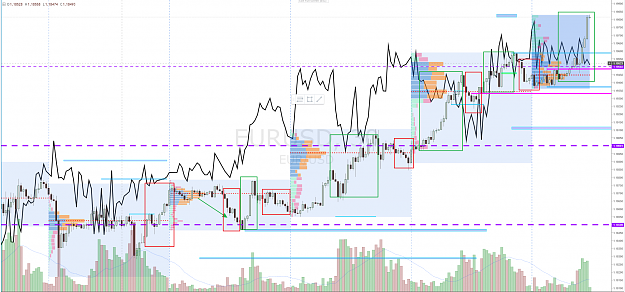

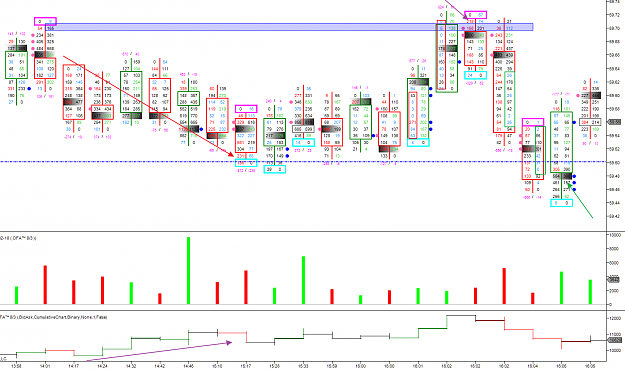

DislikedHello all, I would like to share one of the ways I trade. I look for price to go up and hit Exact Price Levels, (EPL), and I look at Volume. Its simple and works. I took this sell trade Monday evening and closed it this morning.Ignored

@xxxx§|[::::::::::::::::>