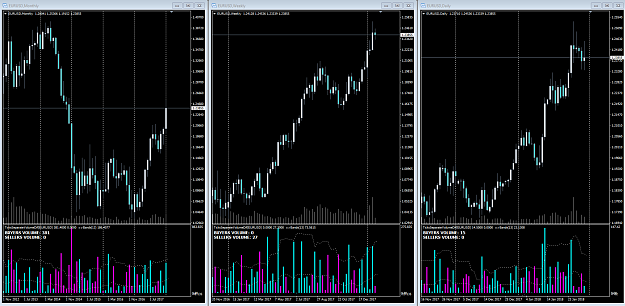

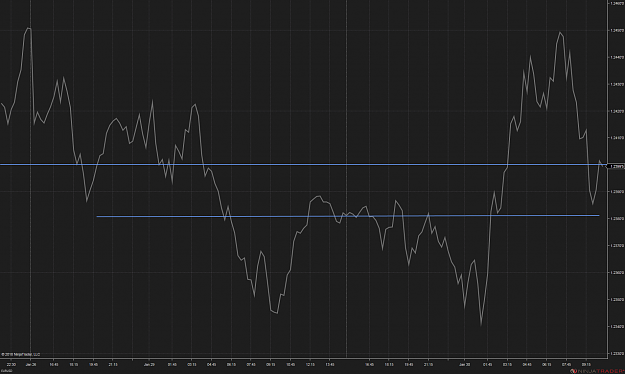

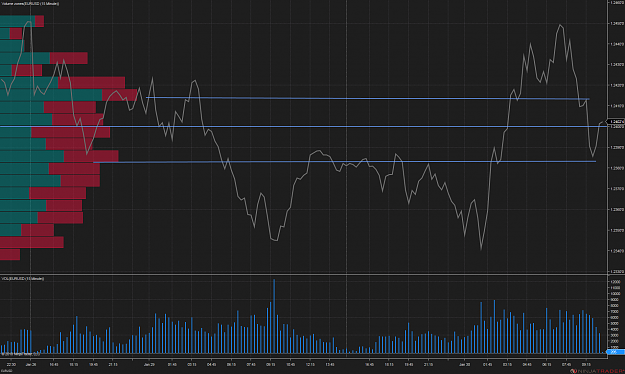

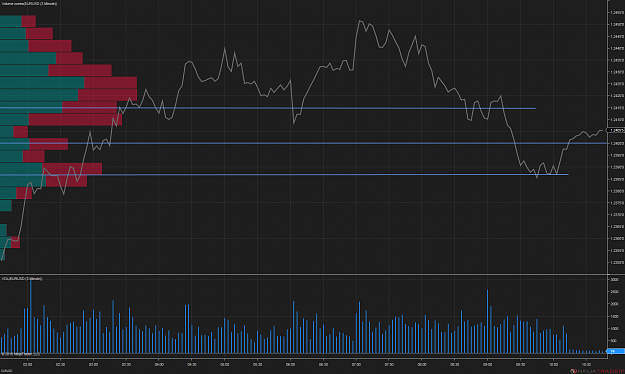

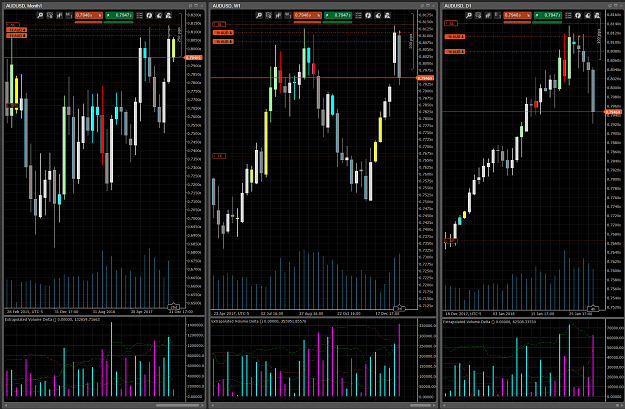

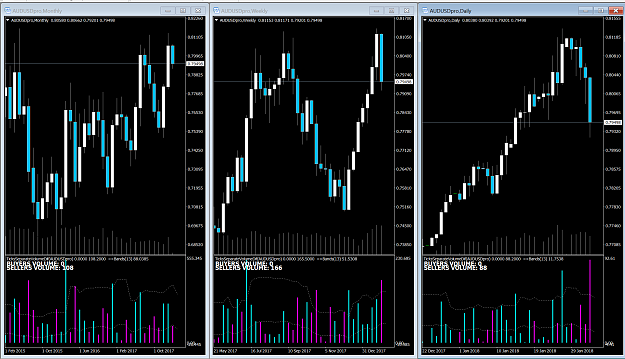

Disliked{image} This is what I am working on. I have done the calculations with Excel and can graph them but putting them together with price action is a royal pain and I am unable to get this to line up perfectly...however... Look at how the delta volume differs entirely from just tick volume. Again this is extrapolated, and I need to study it more and would really need a programmer to help out...I'm sure for a coder, it could be done in a few hours. I am doing it by hand on just EUR/USDIgnored

Long time.

Question:

This Volume Delta indicator you want programmed, is this an attempt to see when larger orders (ie. 5 100 lots -> larger orders vs 100 5 lots -> small orders) are coming through?

Also where are you getting your real volume numbers from, CME? Why not just compare CME Vol to CME tick?

Looks like you're headed in the right direction but you might be going off track with this volume thing.

1