In trading, you have to be defensive and aggressive at the same time

- Post #37,341

- Quote

- Jun 3, 2020 8:13pm Jun 3, 2020 8:13pm

- Joined Feb 2012 | Status: Member | 21,377 Posts

- View Post

- Hidden for breach of Trader Code of Conduct

- Post #37,344

- Quote

- Jun 5, 2020 2:48am Jun 5, 2020 2:48am

- Joined Nov 2009 | Status: You are what you is | 1,956 Posts

Porta itineris dicitur longissima esse

- Post #37,346

- Quote

- Jun 5, 2020 9:54am Jun 5, 2020 9:54am

- Joined Jun 2010 | Status: Member | 1,499 Posts | Online Now

- Post #37,348

- Quote

- Jun 5, 2020 11:21am Jun 5, 2020 11:21am

- Joined Nov 2009 | Status: You are what you is | 1,956 Posts

Porta itineris dicitur longissima esse

- Post #37,349

- Quote

- Jun 5, 2020 12:59pm Jun 5, 2020 12:59pm

- Joined Nov 2012 | Status: Coder | 8,520 Posts

Try don't lose pants never...

- Post #37,350

- Quote

- Jun 5, 2020 3:15pm Jun 5, 2020 3:15pm

- Joined Mar 2016 | Status: Member | 1,612 Posts

- Post #37,352

- Quote

- Jun 6, 2020 8:57am Jun 6, 2020 8:57am

- Joined Feb 2012 | Status: Member | 21,377 Posts

In trading, you have to be defensive and aggressive at the same time

- Post #37,353

- Quote

- Jun 6, 2020 8:59am Jun 6, 2020 8:59am

- Joined Feb 2012 | Status: Member | 21,377 Posts

In trading, you have to be defensive and aggressive at the same time

- Post #37,355

- Quote

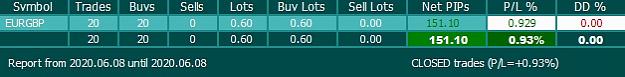

- Jun 8, 2020 6:21am Jun 8, 2020 6:21am

Don't be delicated, be vast and brilliant ! [Brent Smith]

- Post #37,356

- Quote

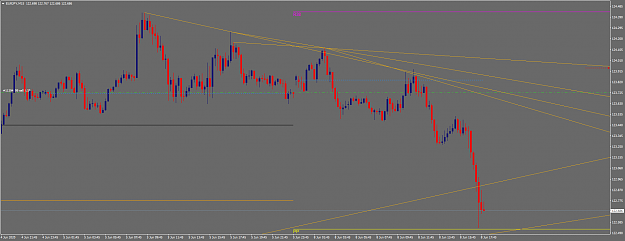

- Edited 8:18am Jun 8, 2020 6:52am | Edited 8:18am

- Joined Jun 2010 | Status: Member | 1,499 Posts | Online Now

- Post #37,357

- Quote

- Jun 8, 2020 9:44am Jun 8, 2020 9:44am

- Joined Feb 2012 | Status: Member | 21,377 Posts

In trading, you have to be defensive and aggressive at the same time

- Post #37,358

- Quote

- Jun 8, 2020 10:07am Jun 8, 2020 10:07am

Don't be delicated, be vast and brilliant ! [Brent Smith]

- Post #37,359

- Quote

- Jun 8, 2020 10:39am Jun 8, 2020 10:39am

- Joined Jun 2010 | Status: Member | 1,499 Posts | Online Now

- Post #37,360

- Quote

- Jun 8, 2020 11:07am Jun 8, 2020 11:07am

Don't be delicated, be vast and brilliant ! [Brent Smith]