Hello,

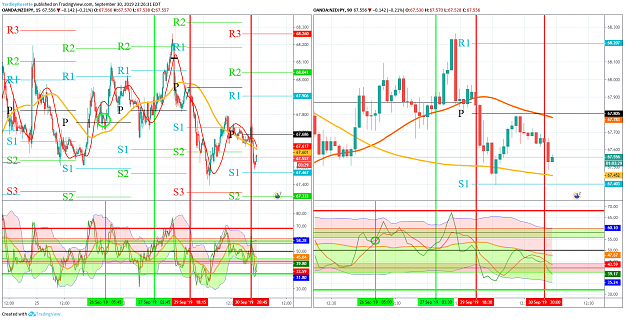

I have problems in entering a position near pivot line.

Cause often a reversal occurs.

Is there anything to support my decision in entering or not entering?

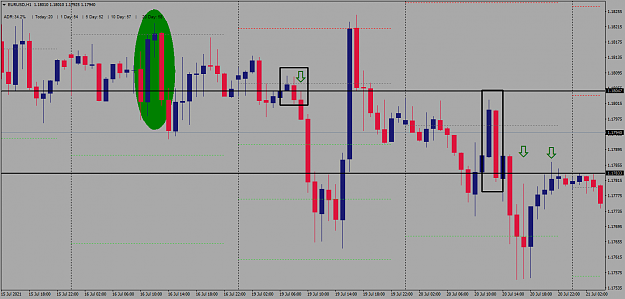

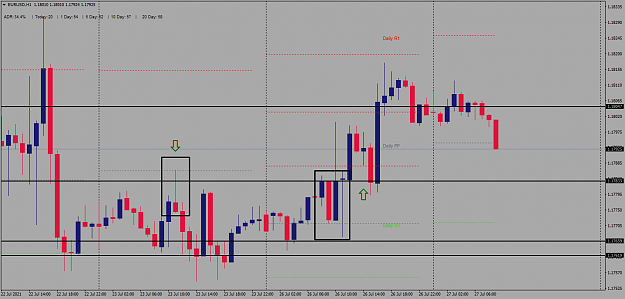

I have problems in entering a position near pivot line.

Cause often a reversal occurs.

Is there anything to support my decision in entering or not entering?