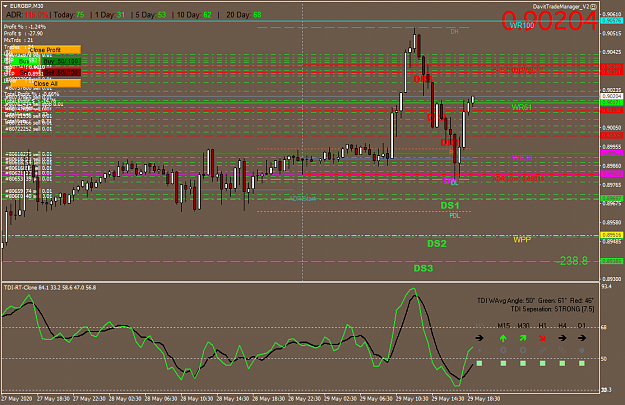

Disliked{quote} Hi Egbert, well, every week I think to remove TDI from the chart, then I leave it as it is.And yes, sometimes my entries are early, however I identified the main issue of mine with the exit, when the price begins to retrace against me more than a certain amount I'm afraid to give back and often I close all positions- It's all in that "I'm afraid" that I have to work on. Best regards, Bubincka

Ignored

if you look at your entry and exit, the right entry would have made up for the early exit?

to wait for the 50 line cross to buy is very conservative?loosing a lot of pips, just my thoughts.

Just an thought.

Nothing is impossible - IHS