Trading made possible with EsikeA+++

Trading made possible with EsikeA+++ is a very simple, robust, effective and trend following system with confirmations and enhancements to ensure and increase the profitability.

This trading system is high performing system and focus on trend identification and how to join the trend.

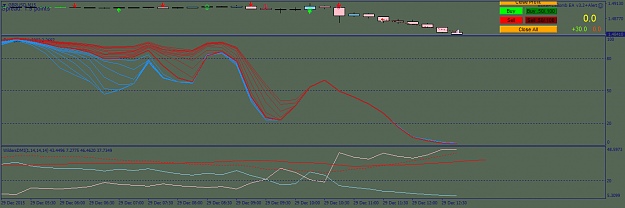

The 3 main components/structures:

1. 5ema - main chart.

2. Welles WeldersDMI - window 1.

3. TrendMirror - window 2.

The Entrance:

1. 5ema - the trigger: - Main chart:

- Arrow - 5 ema with a 2 shift.

* Red Arrow - Short/Sell.

* Lime/Green Arrow - Long/Buy.

2. Trend: Price vs the Daily Open & DPP: - Main chart:

a.) Price above the daily open line (white dotted line) & DPP = Buy.

b.) Price below the daily open line (white dotted line) & DPP = Sell.

3. DMI: - Window 1:

i.) DMI's crossing.

ii.) ADX must be above one of the DMI's.

iii.) ADXr must be above 20 level.

DMI Color:

1. Red line: DMI - (sell).

2. Green line: DMI+ (buy).

3. Red dotted line: ADX.

4. Yellow line: ADXr.

4. TrendMirror: - Window 2: Level 1 Entry

1.The Price To Open (1440) color must be established first, and then the ASH change to match it.

2. The Price To Open (60) color must be established first, and then the ASH change to match it.

3. AbsoluteStrengthHisto2 - (ASH).

6. WUKAR News: - Window 3:

i.) Lime bars: When it is safe according to the rules.

ii.) Red bars: When between 1 hour before and 30 minutes after news.

iii.) DarkGray bars: For the next 30 minutes as a warning to be careful as news may still have an impact yet.

Trading Pairs:

I trade EURUSD, GBPUSD, AUDUSD, and USDJPY, but it will work on any pairs.

Timeframe:

This trading system works on all time frames, but I trade off M30 TF.

My Charts:

I use 5 charts:

i.) Chart with data and News - load with EsikeCalender.tpl.

ii.) EURUSD M30.

iii.) GBPUSD M30.

iv.) AUDUSD M30.

v.) USDJPY M30.

Trading Hours:

London open to London close - ( target/focus hours: 1st 3 hours of London open and 1st 3 hours of NY open).

Trading Rules:

1. No trading H1 before Red news and M30 after Red news.

2. Do not enter trades when the size of the last candle is more than double the ATR of that pairs for that day.

3. Do not enter trade in the first M15 of a new market open.

4. Don't regard all triggers as trade setups.

5. Maximum of 4 trades per day (1 trade per day will do you).

6. Always take a look at the ABR/ATR status, 10ema dashboard, Strength meter and Ichimoku status before taking your trade.

7. Always go by the way of the Daily Open and the DPP - price above =buy / price below =sell.

8. Use Fibonacci Retracement and do not take the signals which are beyond 78.6%.

9. Make PDF & BCC your guide.

Money/Trade Management:

1. MM =2%.

2. TP = 40pips.

3. SL = 20pips.

4. BE/Lock-in-pips = 20pips

5. Daily Target = 40pips.

6. Stop trading after reaching daily target.

7. Stop trading after 2 consecutive losses.

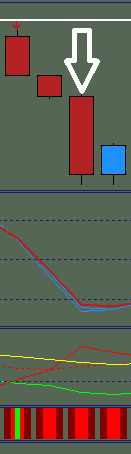

When not to trade:

1. When ADX is below both DMI lines or ADXr is below 20 level.

2. When the shadow/wick of candle is bigger than candle body of that candle that cross the 5ema.

3. When we see "Porcupine" candles.

4. When we see Support/Resistance Ahead.

Checklist:

1. 5ema - (the trigger) – maximum of 2 candles after the trigger and must correspond/line- up with level 1 entry.

2. DMI - both the ADX & ADXr must be inside the DMI's.

3. TrendMirror - level 1 entry.

4. + Others:

a.) Price vs the Daily Open/DPP.

b.) Strength meter - single/double effect.

c.) 10ema dashboard.

d.) Ichimoku status - Sync in pairs.

e.) ABR/ATR status.

Happy trading,

Yomi.

Setups:

Trading made possible with EsikeA+++ is a very simple, robust, effective and trend following system with confirmations and enhancements to ensure and increase the profitability.

This trading system is high performing system and focus on trend identification and how to join the trend.

The 3 main components/structures:

1. 5ema - main chart.

2. Welles WeldersDMI - window 1.

3. TrendMirror - window 2.

The Entrance:

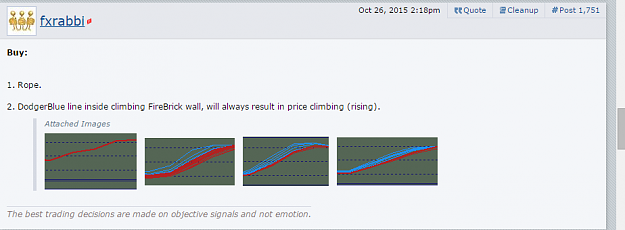

1. 5ema - the trigger: - Main chart:

- Arrow - 5 ema with a 2 shift.

* Red Arrow - Short/Sell.

* Lime/Green Arrow - Long/Buy.

2. Trend: Price vs the Daily Open & DPP: - Main chart:

a.) Price above the daily open line (white dotted line) & DPP = Buy.

b.) Price below the daily open line (white dotted line) & DPP = Sell.

3. DMI: - Window 1:

i.) DMI's crossing.

ii.) ADX must be above one of the DMI's.

iii.) ADXr must be above 20 level.

DMI Color:

1. Red line: DMI - (sell).

2. Green line: DMI+ (buy).

3. Red dotted line: ADX.

4. Yellow line: ADXr.

4. TrendMirror: - Window 2: Level 1 Entry

1.The Price To Open (1440) color must be established first, and then the ASH change to match it.

2. The Price To Open (60) color must be established first, and then the ASH change to match it.

3. AbsoluteStrengthHisto2 - (ASH).

6. WUKAR News: - Window 3:

i.) Lime bars: When it is safe according to the rules.

ii.) Red bars: When between 1 hour before and 30 minutes after news.

iii.) DarkGray bars: For the next 30 minutes as a warning to be careful as news may still have an impact yet.

Trading Pairs:

I trade EURUSD, GBPUSD, AUDUSD, and USDJPY, but it will work on any pairs.

Timeframe:

This trading system works on all time frames, but I trade off M30 TF.

My Charts:

I use 5 charts:

i.) Chart with data and News - load with EsikeCalender.tpl.

ii.) EURUSD M30.

iii.) GBPUSD M30.

iv.) AUDUSD M30.

v.) USDJPY M30.

Trading Hours:

London open to London close - ( target/focus hours: 1st 3 hours of London open and 1st 3 hours of NY open).

Trading Rules:

1. No trading H1 before Red news and M30 after Red news.

2. Do not enter trades when the size of the last candle is more than double the ATR of that pairs for that day.

3. Do not enter trade in the first M15 of a new market open.

4. Don't regard all triggers as trade setups.

5. Maximum of 4 trades per day (1 trade per day will do you).

6. Always take a look at the ABR/ATR status, 10ema dashboard, Strength meter and Ichimoku status before taking your trade.

7. Always go by the way of the Daily Open and the DPP - price above =buy / price below =sell.

8. Use Fibonacci Retracement and do not take the signals which are beyond 78.6%.

9. Make PDF & BCC your guide.

Money/Trade Management:

1. MM =2%.

2. TP = 40pips.

3. SL = 20pips.

4. BE/Lock-in-pips = 20pips

5. Daily Target = 40pips.

6. Stop trading after reaching daily target.

7. Stop trading after 2 consecutive losses.

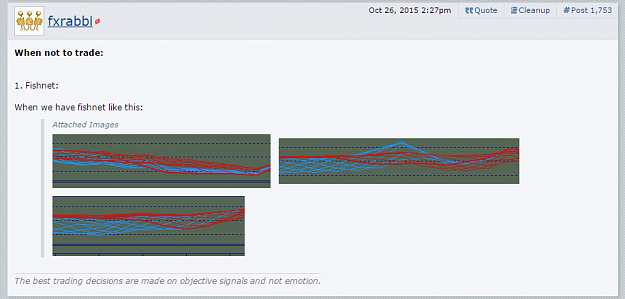

When not to trade:

1. When ADX is below both DMI lines or ADXr is below 20 level.

2. When the shadow/wick of candle is bigger than candle body of that candle that cross the 5ema.

3. When we see "Porcupine" candles.

4. When we see Support/Resistance Ahead.

Checklist:

1. 5ema - (the trigger) – maximum of 2 candles after the trigger and must correspond/line- up with level 1 entry.

2. DMI - both the ADX & ADXr must be inside the DMI's.

3. TrendMirror - level 1 entry.

4. + Others:

a.) Price vs the Daily Open/DPP.

b.) Strength meter - single/double effect.

c.) 10ema dashboard.

d.) Ichimoku status - Sync in pairs.

e.) ABR/ATR status.

Happy trading,

Yomi.

Setups:

Attached Images

Attached File(s)

Be Dumb and Follow Price