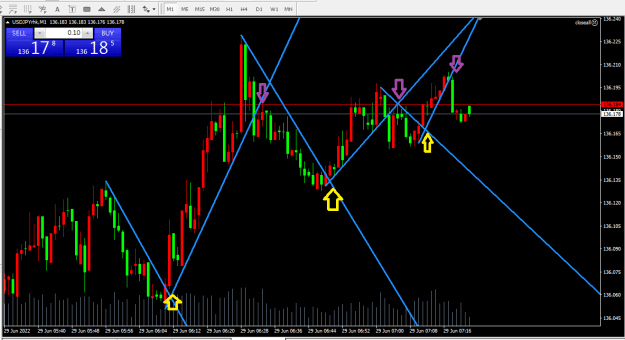

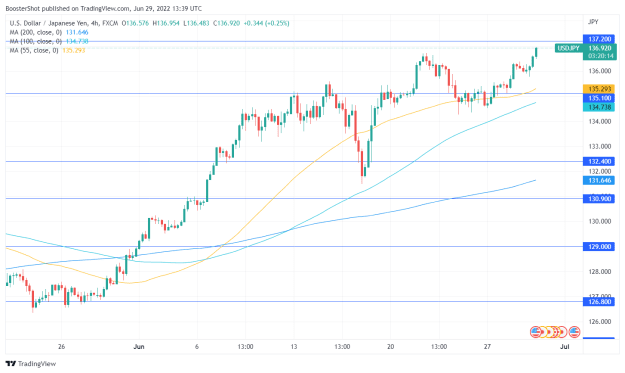

Disliked{quote} i have sold @ 135.42 with real 3 lots(no S/L no T/P) I am waiting for fall But we have not seen it yet 137.20 Let's seeIgnored

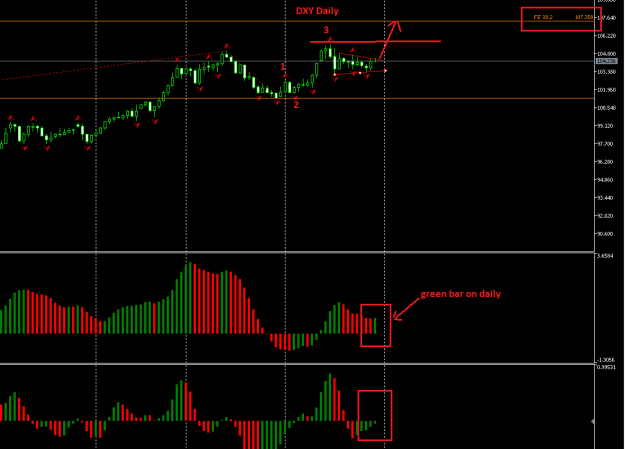

QuoteDislikedNew York Federal Reserve President John Williams said Tuesday he expects the U.S. economy to avoid recession even as he sees the need for significantly higher interest rates to control inflation.

“A recession is not my base case right now,” Williams told CNBC’s Steve Liesman during a live “Squawk Box” interview. “I think the economy is strong. Clearly financial conditions have tightened and I’m expecting growth to slow this year quite a bit relative to what we had last year.”

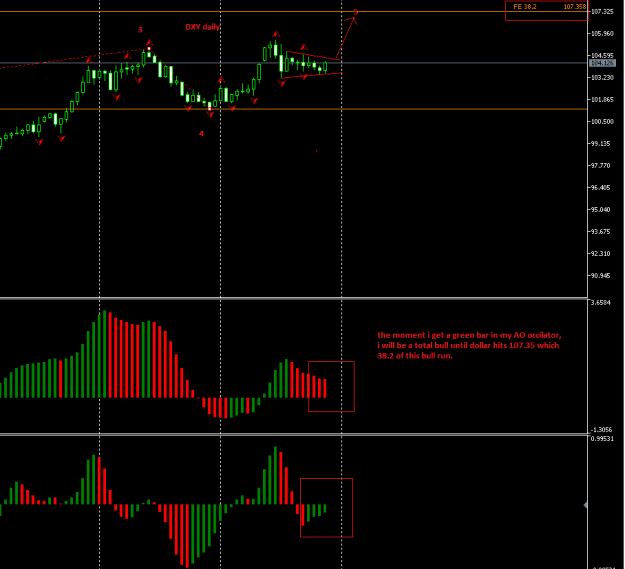

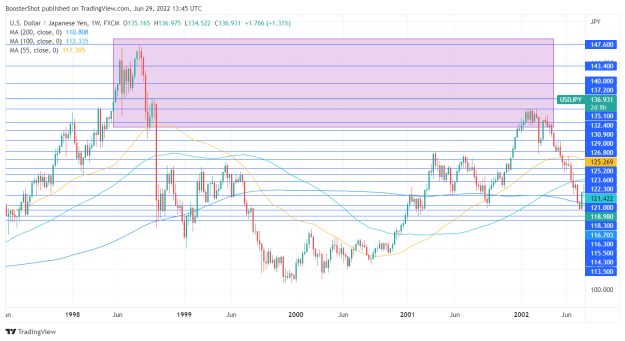

So, there is no data yet to support that a recession is in the U.S. or is coming soon, which should keep USD/JPY elevated. Maybe there is already a recession in the EU zone, which should result in EUR/JPY selling.

don't believe in mumbo jumbo from gurus & charlatans, don't pay them money