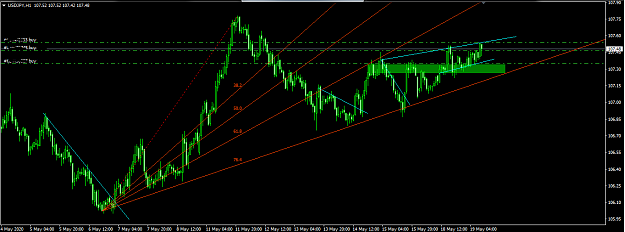

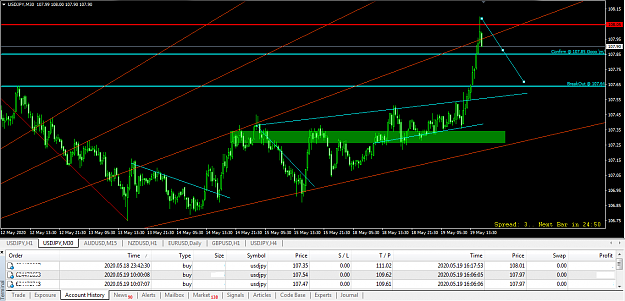

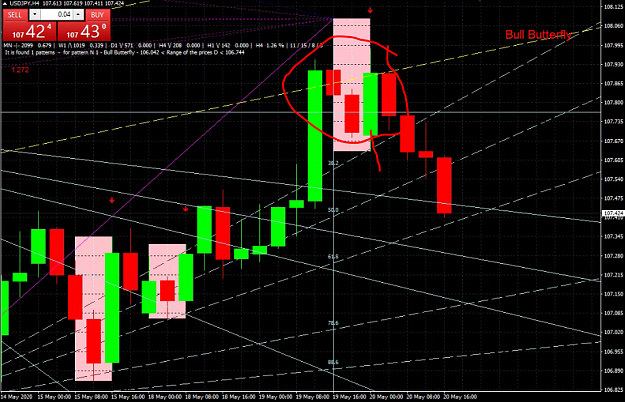

I agree with the buy.

But since we've been on a sideways market for a while now, i think that the breakout could last longer than 108. It could head towards psychological level 110 and then we might see it stabilizing there again for a while. And hopefully after that another big breakout.

But since we've been on a sideways market for a while now, i think that the breakout could last longer than 108. It could head towards psychological level 110 and then we might see it stabilizing there again for a while. And hopefully after that another big breakout.

1