2) The Tick-TPO or "Meta-Profile"

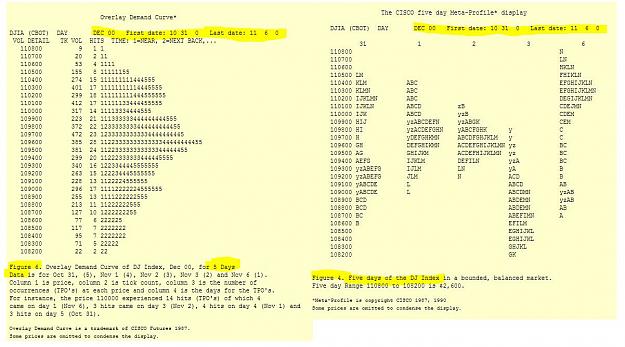

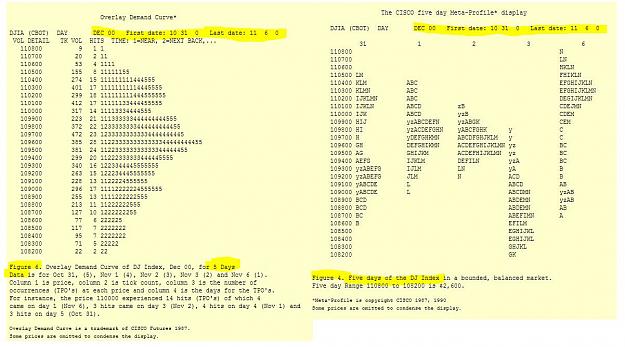

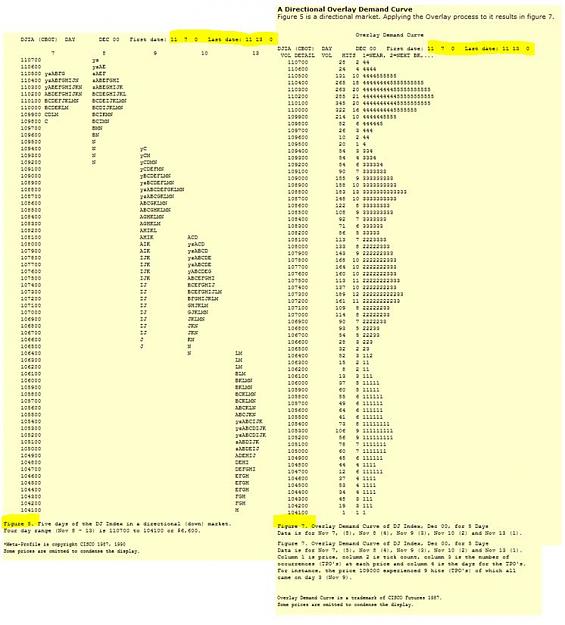

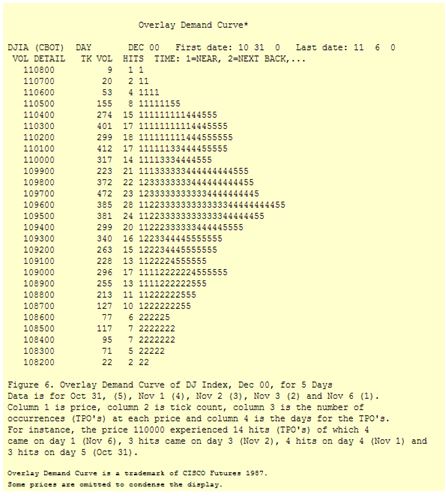

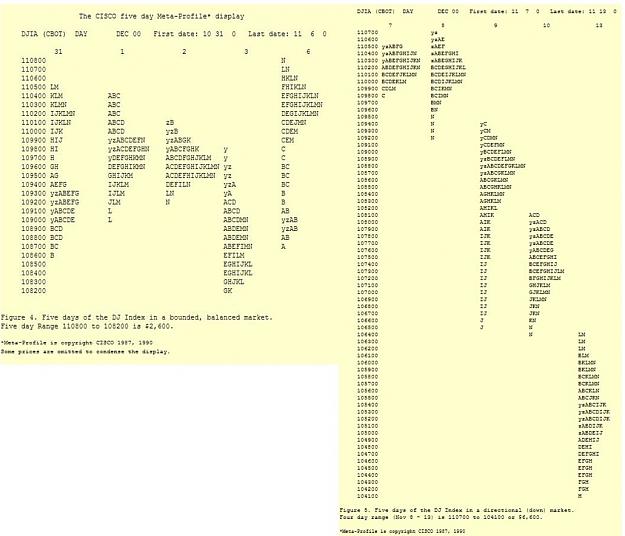

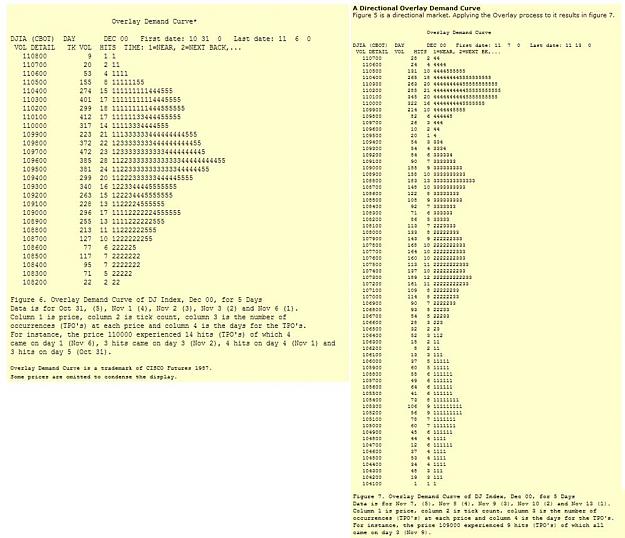

Requiring audited (cleared) data for "Market Profile" methodology excluded most of the auction market world. This problem was solved in 1987 when the "Tick-TPO Profile" was announced. Tick-TPO Profile, later called "Meta-Profile", is a methodology that generates the profile graphic and value area from tick data, either within a day or at end-of-day.

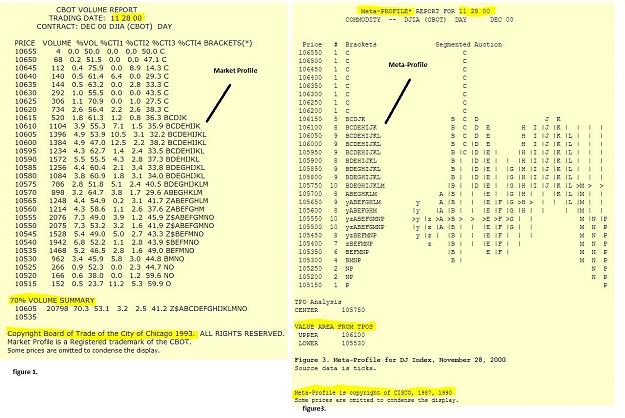

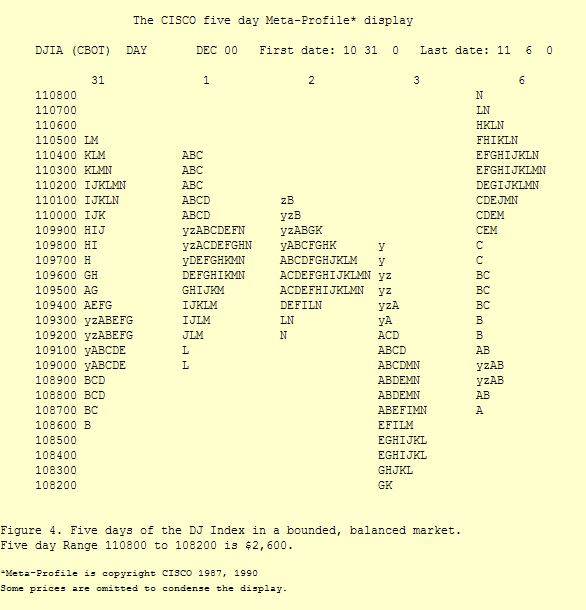

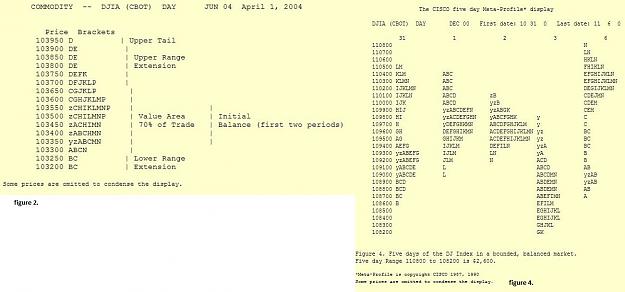

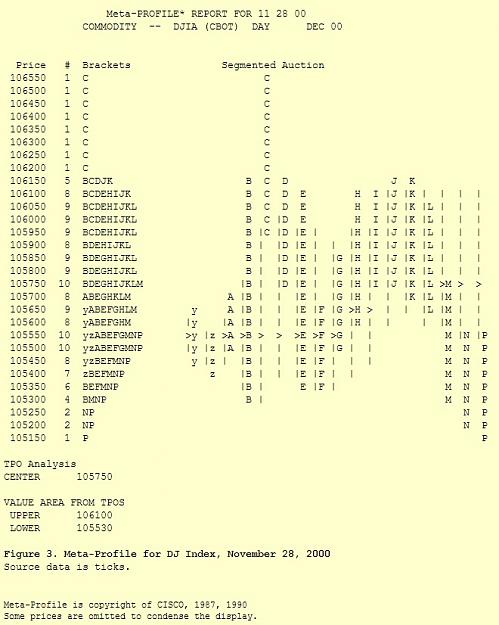

The Meta-Profile Market Graphic

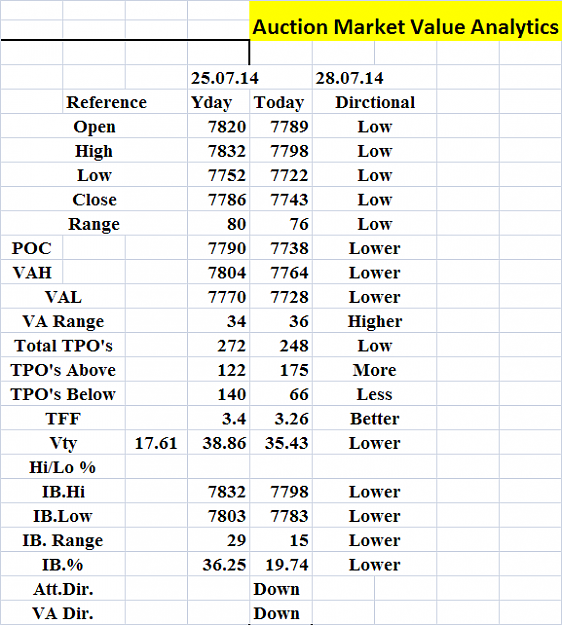

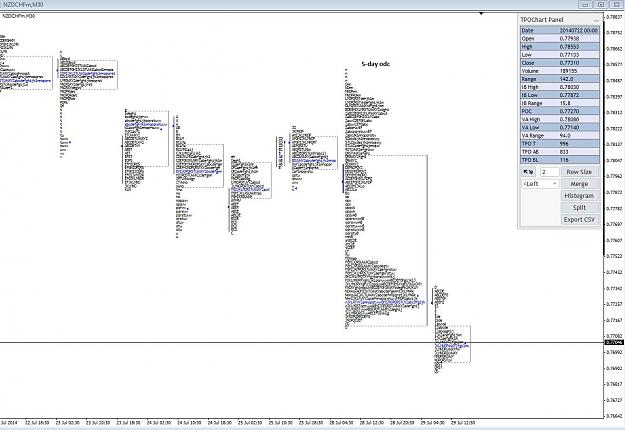

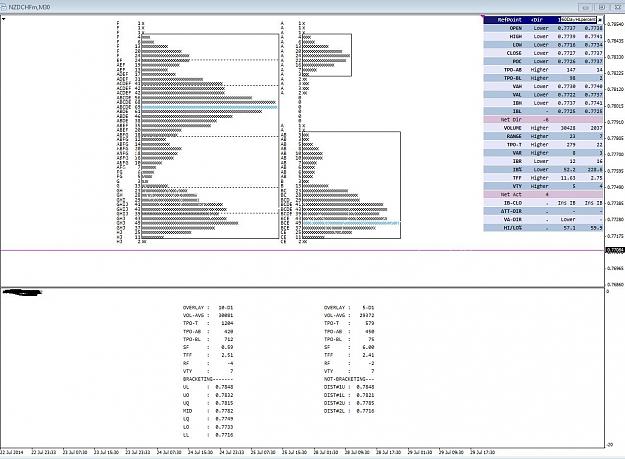

Meta-Profiles generated by ticks create both a profile graphic and a value area. Profile graphics from the LDB audit data and from ticks are usually quite similar and often give virtually identical profile charts. Value area, too, is quite close between the two methods, except in directional markets. Unlike the "Market Profile", Meta-Profile construction and analysis does not rely in any way on the tick data having a gaussian distribution. Other features of "Market Profile" analysis, such as day types and reliance on the gaussian distribution of the profile graphic are not used in Meta-Profile based analyses. Meta-Profile value comes from TPO counts, with no reference to the shape of the Market Profile type graphic. TPO counts play the same role for Meta-Profile value that volume does for the "Market Profile" value area.

Requiring audited (cleared) data for "Market Profile" methodology excluded most of the auction market world. This problem was solved in 1987 when the "Tick-TPO Profile" was announced. Tick-TPO Profile, later called "Meta-Profile", is a methodology that generates the profile graphic and value area from tick data, either within a day or at end-of-day.

The Meta-Profile Market Graphic

Meta-Profiles generated by ticks create both a profile graphic and a value area. Profile graphics from the LDB audit data and from ticks are usually quite similar and often give virtually identical profile charts. Value area, too, is quite close between the two methods, except in directional markets. Unlike the "Market Profile", Meta-Profile construction and analysis does not rely in any way on the tick data having a gaussian distribution. Other features of "Market Profile" analysis, such as day types and reliance on the gaussian distribution of the profile graphic are not used in Meta-Profile based analyses. Meta-Profile value comes from TPO counts, with no reference to the shape of the Market Profile type graphic. TPO counts play the same role for Meta-Profile value that volume does for the "Market Profile" value area.

Markets are not efficient, rather they are effective - Jones