Predictions from Charts, A Critique

Tested with Real Data

Chat at IOAMT: August 25, 2011

Donald L. Jones

CISCO Futures

August 25, 2011

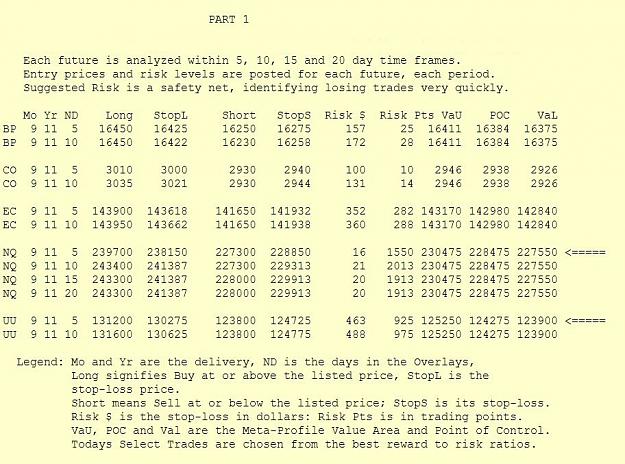

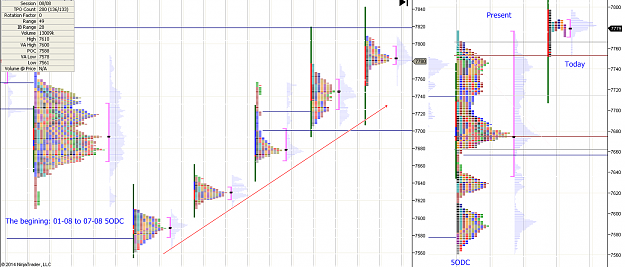

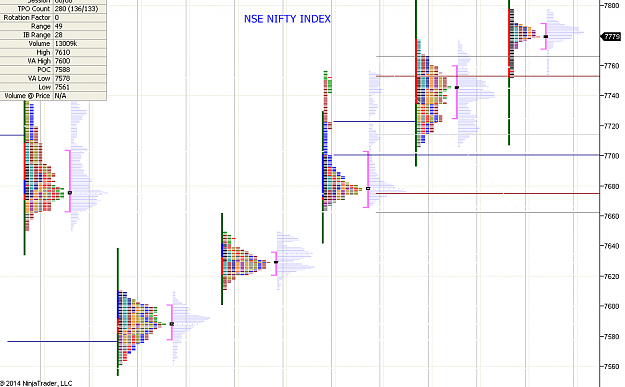

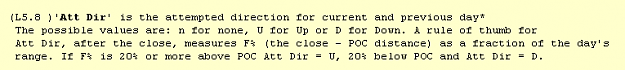

Analysis of auction markets is complicated because of the complexity of the markets themselves. There are many agents (traders), each with agendas of their own. There is constant change in how the players view the market. Market fundamentals are in a constant flux, much of it beyond any trader's ability to learn. Trading is a competition, each tries to win to the disadvantage of the others. Many trade on the news, on calculations (technical analysis), on hearsay, on charts, on tarot cards, etc. But the markets react in ways driven by the wide variety of market descriptors (reference points) present. Naturally, traders seek an 'easy' guide to trade selection. Charts are 'easy'. We will show in this talk that charts can mislead and better yet, there are valid, verifiable analytical methods for trade selection.

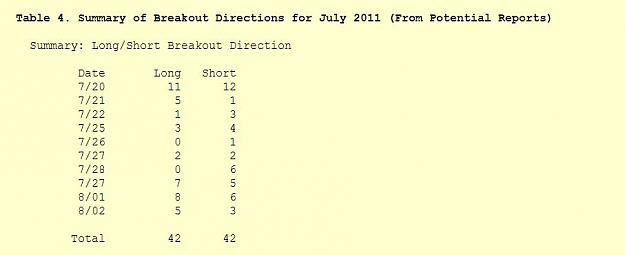

Recently, since around the first of June, the news from many "chart based" prognosticators is that the "markets have turned down". We commented on this news in our July 5 Newsletter (link on CISCO main page). Since then the USA has been involved in the 'Debt Limit' controversy which presumably negatively affects markets. The question is: "are the economists, chartists and other pundits correct in inferring that bearish markets should dictate day-trader's behavior"? A related question is "can you reliably measure if they are right or not"?

cont'd.......

Tested with Real Data

Chat at IOAMT: August 25, 2011

Donald L. Jones

CISCO Futures

August 25, 2011

Analysis of auction markets is complicated because of the complexity of the markets themselves. There are many agents (traders), each with agendas of their own. There is constant change in how the players view the market. Market fundamentals are in a constant flux, much of it beyond any trader's ability to learn. Trading is a competition, each tries to win to the disadvantage of the others. Many trade on the news, on calculations (technical analysis), on hearsay, on charts, on tarot cards, etc. But the markets react in ways driven by the wide variety of market descriptors (reference points) present. Naturally, traders seek an 'easy' guide to trade selection. Charts are 'easy'. We will show in this talk that charts can mislead and better yet, there are valid, verifiable analytical methods for trade selection.

Recently, since around the first of June, the news from many "chart based" prognosticators is that the "markets have turned down". We commented on this news in our July 5 Newsletter (link on CISCO main page). Since then the USA has been involved in the 'Debt Limit' controversy which presumably negatively affects markets. The question is: "are the economists, chartists and other pundits correct in inferring that bearish markets should dictate day-trader's behavior"? A related question is "can you reliably measure if they are right or not"?

cont'd.......

Markets are not efficient, rather they are effective - Jones