My 3 favorite pairs as they are all not correlated to each other whatsoever.

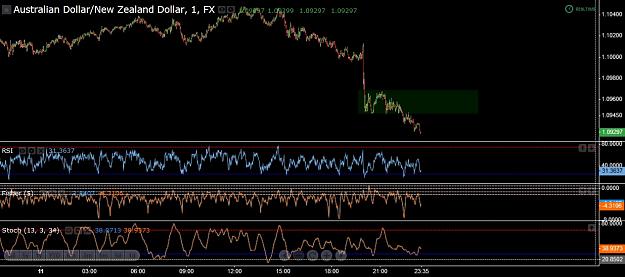

AUDNZD - weekly bottom incoming --- long. 2014 quick correction then bear continue

GBPJPY - weekly top incoming -- neutral looking for shorts. 2014 still a bull

EURUSD - insane demand trying to go for 1.42 --- long. 2014 still a bull

We should see a multi year bear move in USD soon.

Your fundamental catalyst (for all in short) will be the announcement of crude oil futures priced in yuan.

That will be far more drastic than anything the FED could do.

Please only AUDNZD, GBPJPY, EURUSD

Please post only H4, D1 and W1 charts.

Please call targets, potential drawdown before continuing into profit , and estimated time to reach target.

I don't expect this thread to be active at all as we trade the major swings only.

Ill get some charts up later when I'm not on mobile.

AUDNZD - weekly bottom incoming --- long. 2014 quick correction then bear continue

GBPJPY - weekly top incoming -- neutral looking for shorts. 2014 still a bull

EURUSD - insane demand trying to go for 1.42 --- long. 2014 still a bull

We should see a multi year bear move in USD soon.

Your fundamental catalyst (for all in short) will be the announcement of crude oil futures priced in yuan.

That will be far more drastic than anything the FED could do.

Please only AUDNZD, GBPJPY, EURUSD

Please post only H4, D1 and W1 charts.

Please call targets, potential drawdown before continuing into profit , and estimated time to reach target.

I don't expect this thread to be active at all as we trade the major swings only.

Ill get some charts up later when I'm not on mobile.

Be hopeful in a winning position, and fearful in a losing position.