Thanks for the 'heads up' Britpip7.

I will add my comments to your list below. Please see my comments in blue...

AUD/CAD - Long trade active since Friday afternoon. I will discuss this in a separate post to follow.

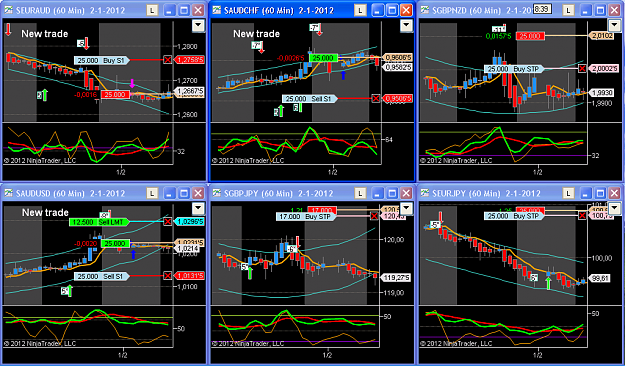

A/U - possible break to the upside - Fractal Up break / TDI strong cross / TMS Osc green for day and week / RSI(10) above 50. Yes I like the look of this one too. Will review at the open of next candle and decide if I will enter or not. Similar look to AUD/CAD.

CAD/CHF - no set up yet but based on divergence this pair is on my watch list for a short. I would be looking for at least 200 pips here.

E/U - sitting on a strong support line for the past 12 days - something has to give at some point. No signal yet.

NZ/U - similar to A/U as usual - Agreed and similar look to AUD/CAD too.

GB/NZ - possible Fractal Low break - TDI has bounced / TMS OSC red for day and week / RSI(10) below 50 - If the Fractal Low break does not occur watch for reversal signals. I am wary of this one... there is divergence between price and the indicators and I expect a move long.

GB/J - similar to GB/NZ - I don't have the confidence yet to trade the 'Ninja Beast'!

AU/CH - possible divergence PA to TDI - waiting for possible reversal - sadly do not have this pair on the Oanda MT4 platform!

The rest of the pairs are already into trend runs or are seriously ranging - so, worth watching the trending pairs for a pause / fractal break - some of these are getting into OB / OS areas so be careful with new entries - maybe go for smaller profit targets. Agreed. In a number of cases entries were signalled 3 - 5 days ago and there have been decent moves as a result. Time for patience to wait for new and solid set ups.

I will add my comments to your list below. Please see my comments in blue...

AUD/CAD - Long trade active since Friday afternoon. I will discuss this in a separate post to follow.

A/U - possible break to the upside - Fractal Up break / TDI strong cross / TMS Osc green for day and week / RSI(10) above 50. Yes I like the look of this one too. Will review at the open of next candle and decide if I will enter or not. Similar look to AUD/CAD.

CAD/CHF - no set up yet but based on divergence this pair is on my watch list for a short. I would be looking for at least 200 pips here.

E/U - sitting on a strong support line for the past 12 days - something has to give at some point. No signal yet.

NZ/U - similar to A/U as usual - Agreed and similar look to AUD/CAD too.

GB/NZ - possible Fractal Low break - TDI has bounced / TMS OSC red for day and week / RSI(10) below 50 - If the Fractal Low break does not occur watch for reversal signals. I am wary of this one... there is divergence between price and the indicators and I expect a move long.

GB/J - similar to GB/NZ - I don't have the confidence yet to trade the 'Ninja Beast'!

AU/CH - possible divergence PA to TDI - waiting for possible reversal - sadly do not have this pair on the Oanda MT4 platform!

The rest of the pairs are already into trend runs or are seriously ranging - so, worth watching the trending pairs for a pause / fractal break - some of these are getting into OB / OS areas so be careful with new entries - maybe go for smaller profit targets. Agreed. In a number of cases entries were signalled 3 - 5 days ago and there have been decent moves as a result. Time for patience to wait for new and solid set ups.